Quick Overview

The latest G-19 Consumer Credit Report has shed light on an alarming trend in the credit union sector: a rise in delinquency rates, particularly in credit card collections.

This trend, revealing a slowdown in consumer lending growth, is impacting even major credit unions and community banks like Navy Federal and Pentagon Federal. As these challenges grow, credit unions are urgently seeking effective solutions to navigate these waters.

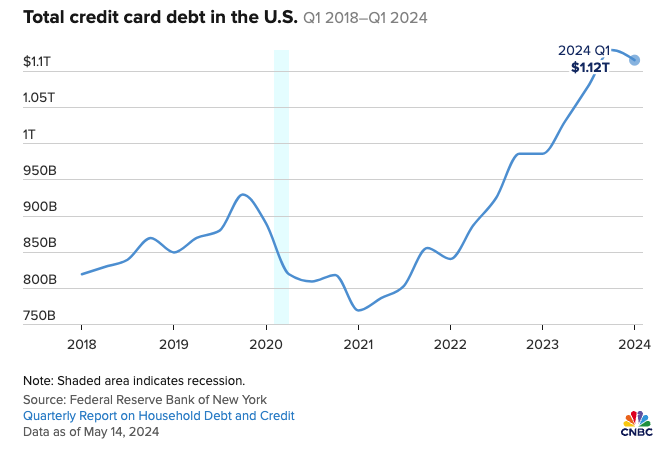

Americans now owe $1.12 trillion on their credit cards, the Federal Reserve Bank of New York reported Tuesday, with the average consumer carrying $6,218 in credit card debt, up 8.5% year over year, according to a quarterly report from TransUnion.

Eltropy’s Unified Conversations Platform is designed specifically to address and streamline the debt recovery processes for credit unions and community banks. Our solution offers a strategic and efficient approach to overcoming the critical collection challenges you face today.

Why Credit Union and Community Bank Collection Teams Choose Eltropy:

- Efficiency in Debt Recovery: Eltropy’s platform makes your debt recovery process more efficient and effective. By streamlining these processes, credit unions and community banks can see quicker results, directly impacting their bottom line.

- Enhancing Agent Well-Being: We understand the stress and challenges faced by collection teams. Eltropy is thoughtfully designed to prevent burnout, ensuring that your team’s well-being is a priority. A happier, healthier team leads to better performance and results.

- Tailored Collection Strategies: Every member has unique needs and circumstances. Eltropy’s adaptable approach to credit card collections allows for customized strategies that are more likely to yield positive outcomes.

Experience firsthand how our platform can make an immediate and significant impact on your credit card collection efforts.

Eltropy could be the game-changing solution your credit union and community bank needs to effectively tackle the growing challenge of credit card delinquencies. Don’t let this trend impact your operations and staff morale. Take the first step towards revolutionizing your collection process by booking a meeting with one of our Digital Collections Experts.