Quick Overview

Fraud is more than just an inconvenience – it’s a pressing, ever-growing threat that community banks can’t afford to ignore. And, Cybersecurity isn’t just an IT concern anymore – it’s a recurring headline, a growing budget item, and in some cases, a potential shutdown for small businesses.

The 2024 CSBS Annual Survey of Community Banks also highlighted just how serious this issue is, with cybersecurity now ranked as the highest internal risk to banks.

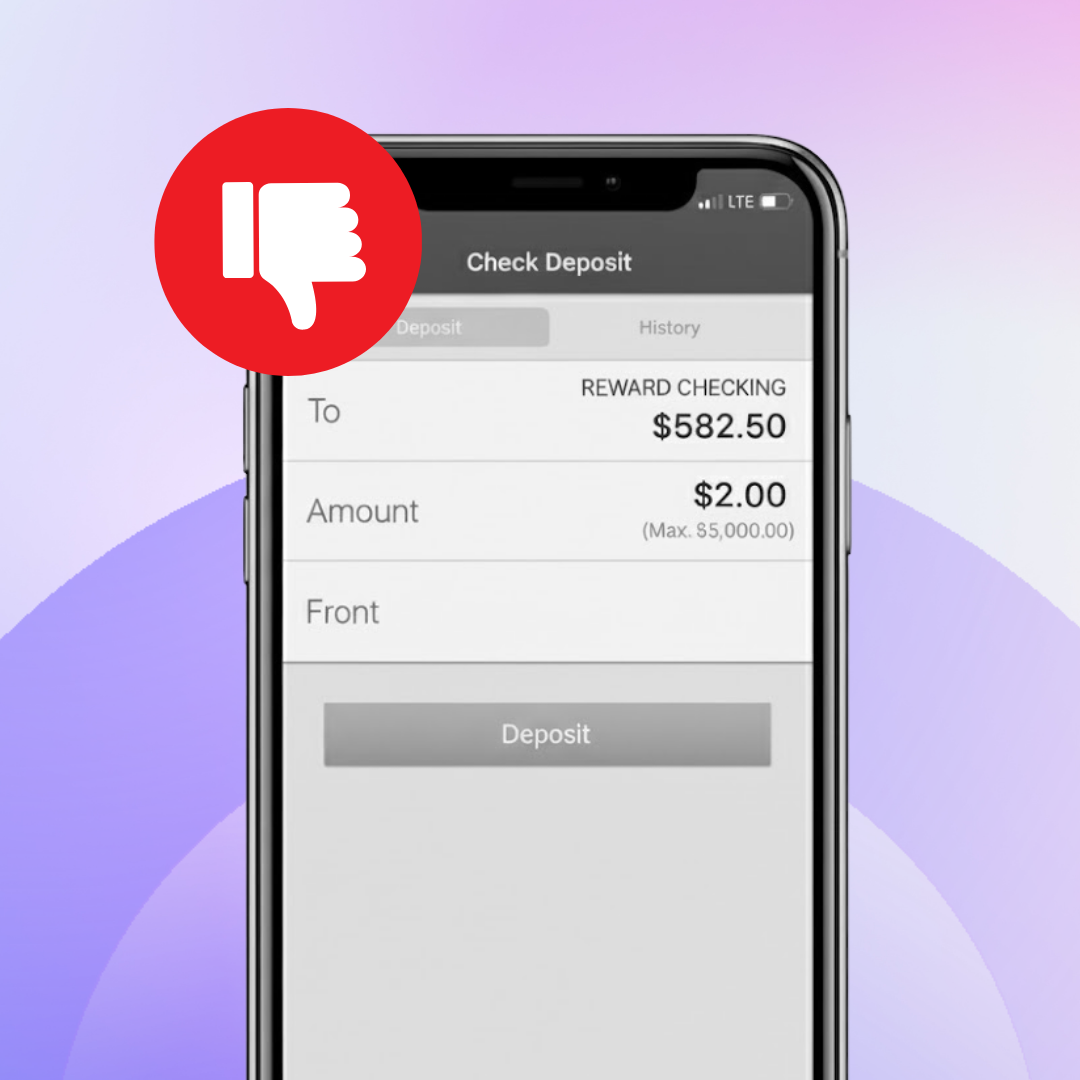

A modern small business relies on multiple third-party tools to run its operations – From CRM and point-of-sale systems to payroll platforms and payment processors. Digital banking has unlocked new levels of convenience, speed, and ease for these small businesses, but it’s also providing a fertile ground for fraud!

Now, we understand that you already remind your customers (again and again) to change their passwords, avoid shady links, and host cybersecurity webinars with coffee and donuts 🙂

But the future of fraud prevention for community banks can not be just about sending alerts or building firewalls, it also has to be about being proactive, predictive, and relentlessly human in the time of their utmost need (and fear).

Here’s how.

You are their First Call! Show Up When It Matters

When a breach hits and your customers are caught in the blast radius, you are their first call. They need their trusted banker to understand the urgency, move fast, and help them protect what they’ve built.

At this point, they don’t want to wait to hold music, automated emails, or make an appointment at a branch – they need you face-to-face, and they need you right now!

How you respond in moments like these defines your relationship fast-forward fraud!

This is where Eltropy’s secure Video Banking becomes your superpower – Deliver that level of urgent, personal support — anytime, anywhere!

A secure, encrypted platform that empowers community banks to offer live, face-to-face support to business customers, no matter where they are. Whether it’s reviewing recent transactions, closing compromised accounts, or issuing new credentials, your team can help with everything they need – when they need it the most!

Why Video? You can instantly verify user identities via video, reduce fraud exposure, and minimize business disruption by helping customers bounce back fast!

Empower Your Teams to Act — Not Just React

Fraud is evolving faster than ever, but fortunately, so is the technology built to fight it.

With Eltropy’s Fraud Prevention, your frontline teams transform into first responders– not just watching the alerts roll in but verifying identities, shutting down threats, and guiding customers through recovery with calm, clarity, and care.

It’s a redefinition of support – easy, more personal, and built for the speed of today’s threats. And in this race against fraud, community banks don’t just have to keep pace, they can reimagine what’s possible — with Eltropy.