Quick Overview

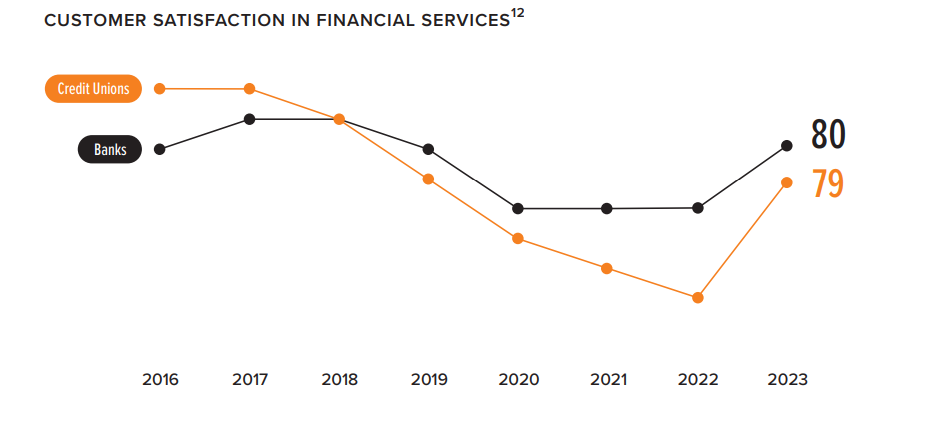

Credit unions have always built their reputation on trust, community, and putting members first. But in today’s fast-moving financial world, those strengths alone won’t cut it. Banks are getting smarter, fintechs faster, and even non-financial services are muscling into your members’ wallets.

So how do you do more than survive? How do you truly stand out without losing the cooperative values that define you?

As Harvard strategist Michael Porter famously said, “Competitive strategy is about being different. It means deliberately choosing a different set of activities to deliver a unique mix of value.” Thriving today means making bold choices: deciding where to go all-in and where to step back.

Caroline Vahrenkamp, Director of the Advisory Services’ latest report from the Filene Research Institute, uncovers how credit unions can strike this delicate balance. The report highlights the top challenges facing credit unions and features exclusive insights from Angela Faust, COO of Credit Union of Texas, on how they’re using Eltropy to tackle these challenges head-on.

In this blog, we’ll break down those challenges and share how Eltropy One Platform gives credit unions like yours a competitive edge to unlock new opportunities and drive real impact.

Leveraging Technology Without Losing Trust

With 73% of U.S. firms already using AI in at least one business area, credit unions can’t afford to stay on the sidelines. Members now expect every interaction to be instant, intelligent, and effortless, just like they get from every other app on their phone.

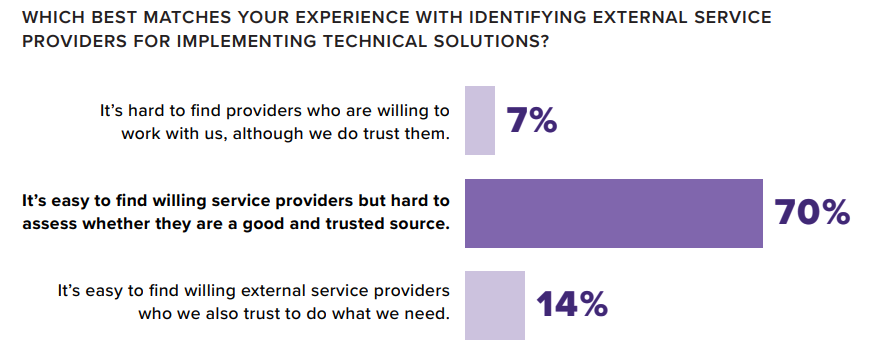

Yet the Filene report exposes a troubling paradox: while 70% of credit unions say it’s easy to find technology vendors, only 14% feel confident that those vendors are truly trustworthy and capable.

The real question keeping leaders up at night isn’t whether to adopt AI – it’s how to do it without jeopardizing member trust or data security.

The Eltropy Edge

Angela Faust, COO of Credit Union of Texas (CUTX), captures the turning point with Eltropy AI – “We couldn’t keep asking members to wait on hold while a handful of agents fielded every routine call. By deploying Eltropy’s AI and virtual assistant ‘Bethany,’ we introduced chat-, text-, and voice-based service that works around the clock.”

And, the results were immediate: “On average, we’re seeing 50% of our members utilize our AI bot when they call in, and 90% of those interactions are completely contained. This gain in efficiency has allowed us to upskill staff and offer them growth opportunities.”

With Eltropy, credit unions escape the false choice between innovation and integrity. You can modernize confidently, automate intelligently, and still keep the human heart beating inside every interaction.

Attracting and Retaining Talent in a Competitive Market

The report further flags a growing talent crisis: credit unions aren’t just competing with each other anymore, they’re up against banks, fintechs, and tech giants offering faster growth, flexible work, and modern tools.

Leadership turnover is high, and burnout is mounting – about 37% of credit unions had different CEOs in 2013 than they did just five years earlier.

Caroline emphasizes a simple truth: Retention isn’t just about pay or perks. If employees spend their days on repetitive, manual tasks, engagement drops, and so does retention.

The Eltropy Edge

At Credit Union of Texas (CUTX), the leadership team faced a familiar dilemma: how to do more with the same number of people, without burning them out. Instead of treating automation as a cost-cutting measure, CUTX turned to Eltropy to transform it into a career catalyst.

Angela Faust highlighted, “Employees don’t join credit unions to spend all day resetting passwords. By automating ‘table-stakes’ tasks, CUTX used AI to enhance rather than replace its workforce. Our goal is to empower staff to focus on what truly matters.”

“Our choice to upskill staff rather than cut them in a volatile rate environment sends a powerful message. Technology is a retention tool, not a headcount reducer, she added.

With Eltropy, automation becomes empowerment, giving employees back time, purpose, and pride in the impact they create every day.

Navigating Rate Volatility Without Sacrificing Service

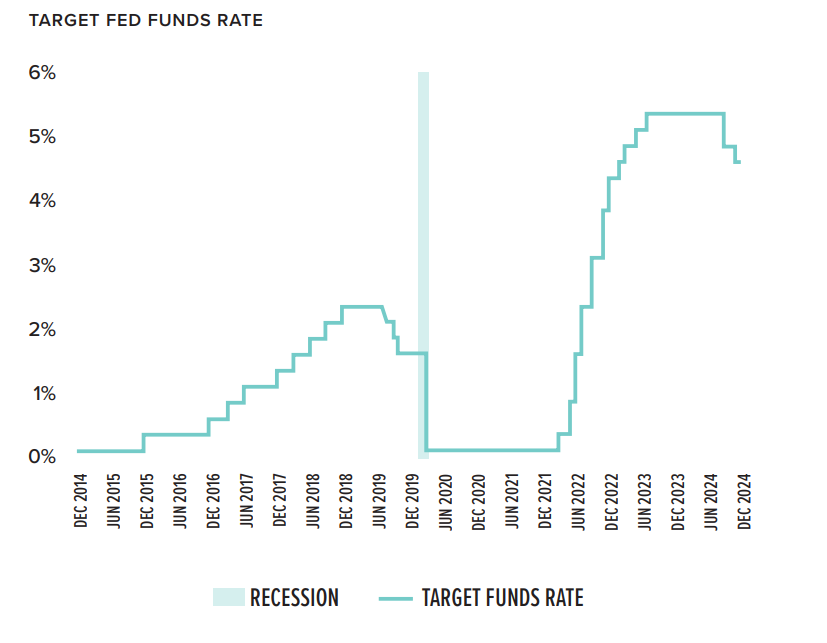

Interest rate swings are hitting harder and faster than anything since the 1980s. High-rate term deposits locked in during the rate increase cycle can crush margins when rates drop, yet members still expect reliable, seamless service.

Vahrenkamp’s report draws a crucial distinction: operational efficiency isn’t enough. Credit unions need operational effectiveness, making every dollar work harder to generate revenue and value. Institutions that get this right have buffers to handle volatility; those that don’t have little margin for error.

The Eltropy Edge

At CUTX, AI became the lever to maintain both productivity and service quality during turbulence. “Rising rates squeeze margins, but CUTX used the AI platform to improve productivity and service rather than reducing headcount. Eltropy’s unified communications platform lets credit union employees switch seamlessly between chat, text, and voice,” Faust explains.

So, when rates change or new products launch, staff can focus on proactive outreach, fraud monitoring, and member education rather than dealing with an avalanche of balance inquiries. This operational efficiency helps the credit union navigate a volatile economic environment without sacrificing member service.

In unpredictable times, credit unions that keep staff available for members while others cut corners will stand out, trusted, resilient, and ready for growth.

Differentiating in a Commoditized Market

Products alone won’t differentiate you.

An average consumer holds 5–7 accounts across different financial providers. And according to the Filene report, 83% of credit unions look virtually identical to any other financial institution.

Checking accounts, auto loans, mortgages – these are commodities. The real question is how you deliver these services in a way no one else can.

The Eltropy Edge

CUTX tackled this head-on by deploying Eltropy AI assistant to handle routine transactions, freeing employees to focus on the interactions that truly differentiate the credit union.

“In a commoditized market, our competitive edge is the human touch,” Faust notes. “Yet as members demanded faster, more accessible service, we responded by automating table-stakes tasks through our AI assistant.”

The transformation is striking: “Now members get instant answers or can schedule virtual appointments, while employees devote their energy to complex conversations and financial coaching. By offloading the mundane and doubling our capacity for routine inquiries, CUTX can invest in the differentiated experience other institutions struggle to offer,” she added.

Achieving Scale Without Losing Identity

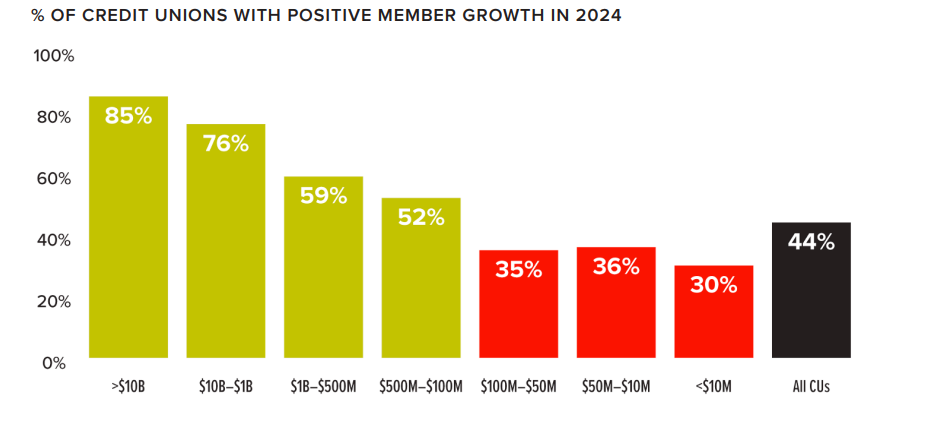

Consolidation is reshaping the credit union landscape. The Filene report reveals that only 44% of all credit unions and 40% of those under $1 billion achieved positive member growth in 2024. Scale clearly impacts both growth potential and competitive viability.

But how do you grow without losing the member focus and cooperative values that define you? Building enterprise-grade technology in-house is expensive and time-consuming, yet without it, keeping pace with member expectations is nearly impossible.

The Eltropy Edge

“Scaling isn’t just about adding branches,” Faust explains. “Our partnership with Eltropy gave us enterprise-grade capabilities that would be cost-prohibitive to build alone. They also committed to adding requested features to their roadmap, reinforcing true collaboration.”

By leveraging Eltropy’s unified platform, including text messaging, secure chat, video banking, co-browsing, and AI-powered chatbots, CUTX expanded its capabilities rapidly and efficiently.

“Partnerships like this let credit unions punch above their weight,” Faust adds. “We can quickly roll out new channels and keep pace with member expectations without sacrificing compliance or security.”

With Eltropy, scaling through partnership, not just consolidation, lets credit unions grow competitively while staying true to their members and cooperative values.

The Path Forward

The credit union industry stands at a pivotal moment. The challenges you face – workplace transformation, technology adoption, regulatory demands, and member expectations – aren’t obstacles; they are opportunities to differentiate, innovate, and lead.

CUTX reveals a fundamental truth: AI isn’t the threat to credit unions’ member-first philosophy. Because when Eltropy AI handles the routine, humans can focus on the remarkable. When technology provides 24/7 availability, staff can dedicate their expertise to complex problems. When automation increases efficiency, credit unions can invest in differentiated experiences.

The question for credit union leaders isn’t whether to embrace these changes. It’s whether you’ll lead them, or be left behind.

Ready to turn your strategic challenges into competitive advantages? Learn how Eltropy’s One Platform can help your credit union gain a competitive edge. Talk to our experts now!