In the last few years, our way of life and doing business has gone through tremendous changes. Businesses across the globe are undergoing “digital transformations”, altering their practices or business models to cater to the rising demand for digital services.

In 2021, the global digital transformation market size was valued at $521 billion, and is anticipating a compound annual growth rate of 19% between now and 2026. But what does this all mean? In short, the increasing use of mobile devices, smartphones, tablets and other forms of technology has brought a growing demand for advanced digital features.

Consumers are more comfortable navigating apps and web portals while dealing with businesses, and with this rise in digital fluency, consumer expectations have risen as well.

But businesses aren’t undergoing digital transformations purely to meet the demands of customers. Some have also invested in digital services because of the monetary value they provide.

Digital implementations help businesses expand their service footprint and extend their hours of operation. A transformation allows a business to leverage services through efficient online tools, negating the inconvenience of in-person meetings.

With these new practices, businesses are opening new streams of revenue while also driving brand loyalty and customer satisfaction. Studies have shown that 80% of businesses that undergo digital transformation report an increase in profits, while 85% report an increased market share. Enhanced data collection and more efficient resource management are also common benefits of digital transformation.

Why Personalization is Key

For businesses that sell generic, out-of-the-box products, personalization may not have to play a key role in their digital strategy. However, community financial institutions (CFIs) have a more nuanced relationship with their customers. Because everyone’s financial situation is unique, a one-size-fits-all approach isn’t always effective in the financial services industry. As Colleen Dabbs put it in The Financial Brand, “Much more than just good targeting for offers, organizations need to engage contextually, in real-time, helping customers reach their financial goals.”

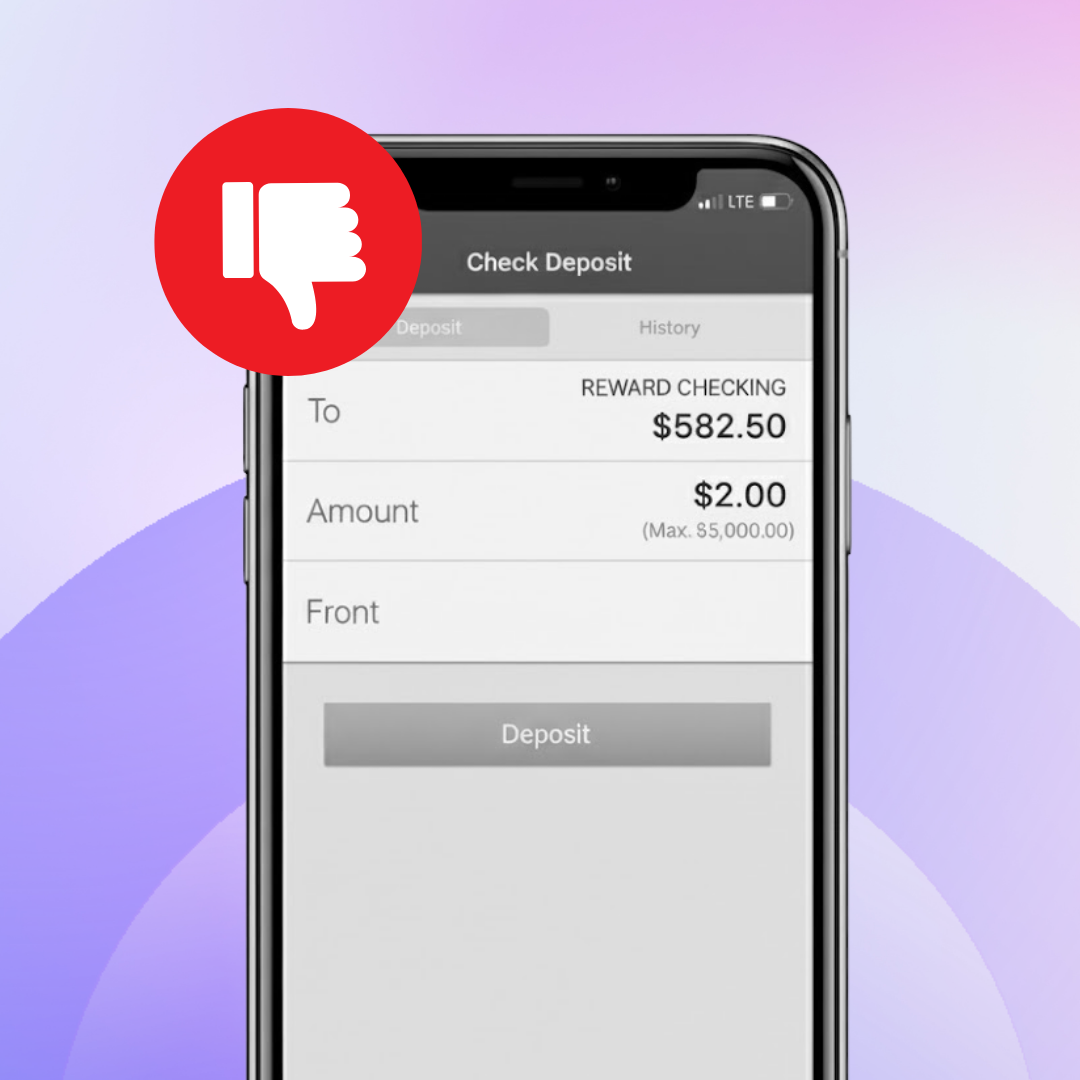

But what does that kind of all-encompassing, hands-on approach look like? Translating all the services of a fully operational branch into a functional and easy-to-use app is not an easy task.

The answer, says Jim Marous, CEO of the Digital Banking Report, is that CFIs need to blend the speed and convenience of their digital tools with the friendly and personalized services of their customer-facing staff.

“Banks and credit unions must focus on building a distribution network that combines the qualities of human interaction with the power of new technologies,” Marous writes.

When it comes to targeted ads and other specified offers, data collection can be highly beneficial practices for CFIs. In a survey, Mckinsey showed that triggered communications—typically featuring personalized product recommendations—contributed to 5-15% increases in revenue and 10-30% increases in marketing spending efficiency.

While those numbers alone are an incentive for CFIs to be thinking about personalization in their digital marketing practices, there’s a lot more to the story. Enhanced selling isn’t the only benefit that personalization can have. As BCG stated in their publication on the topic, “Personalization in banking is not about selling, yet many banks tend to focus on the sales arena.”

Instead of being limited to the sales and marketing arena, personalization can comprise a large part of a CFI’s strategy in coming years. “The combination of data, analytics, applied insights and new engagement models will open the door for an exponential increase in ideas and innovations for new products, services, engagement options, and communication strategies,” writes Jim Marous.

With what he calls the “hybrid distribution model”, Marous says that banks and credit unions can meld technology and data collection with the assets provided by their customer-facing staff and their in-branch product experts.

People are Just as Big a Part of the Equation as Technology Is

Balancing digital self-service technology with the engagement of CFI representatives has been shown to lower the abandonment rate of services like loan applications and new account openings. Instead of exiting the page when they hit a snag, these customers are given the opportunity to work with the specialist that best fits their needs.

When they can’t access a branch, yet still need to complete a banking transaction that can’t be accomplished on their own, customers need to know that their CFI will still be able to serve them. In the digital world, even collaborative, in-depth banking services need to be accessible outside the branch.

By showing your customers that your CFI can deliver friendly, personalized service—whether it be through web, mobile, or in-branch channels—you do more than just enhance your customer satisfaction rating. You open the door to new opportunities, securing new streams of revenue and investing in your ongoing digital relevance.

To learn more about Digital Communications and the ways it could benefit your financial institution, schedule a free demo today!