In the swiftly evolving financial landscape, Artificial Intelligence (AI) has emerged as a catalyst for transformation, revolutionizing the way credit unions, community banks, and their call centers operate. The integration of AI technology offers a plethora of opportunities to enhance services, streamline operations, and provide personalized experiences.

In this blog post, we’ll take you through a comprehensive step-by-step guide to navigate the AI landscape, focusing on the significance of AI in call centers for credit unions and banks.

Understanding AI’s Basics: A Primer for Credit Unions and Banks

AI, at its core, involves machines simulating human intelligence processes. For credit unions and community banks, AI offers a way to harness data insights, automate tasks, and optimize member experiences. Key concepts to understand include:

- Machine Learning: AI’s subset, machine learning, involves training algorithms to learn patterns from data, enabling them to make predictions or decisions without being explicitly programmed.

- Natural Language Processing (NLP): NLP empowers machines to understand, interpret, and respond to human language, enabling AI-powered chatbots to converse with members effectively.

- Predictive Analytics: Predictive analytics utilizes historical data to forecast future trends, assisting institutions in making informed decisions and enhancing member experiences.

Identifying AI Opportunities: Where to Begin

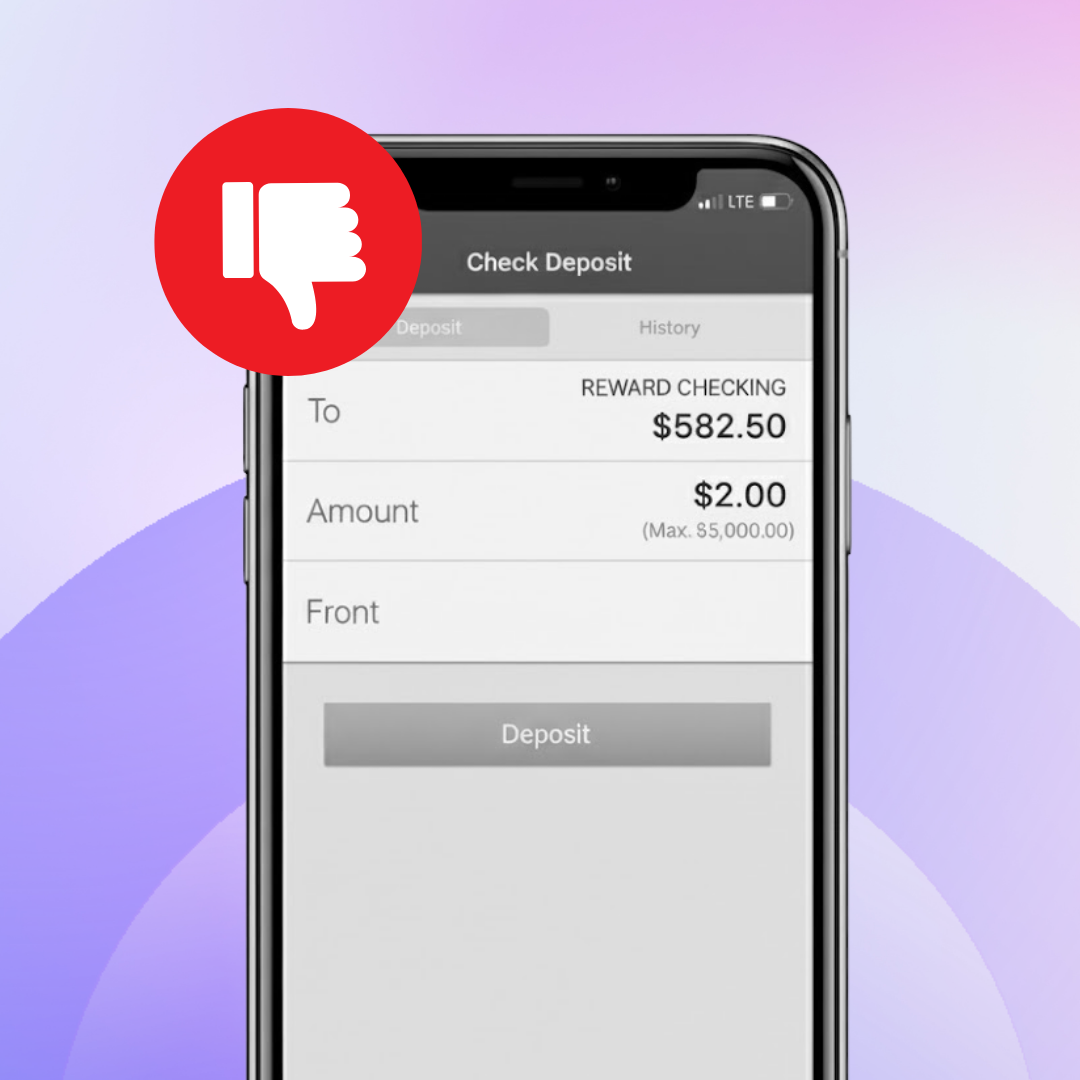

- Fraud Detection and Prevention: With fraud on the rise and fraudsters only getting smarter, it’s increasingly imperative to match them by using smart tools to your advantage. AI-driven algorithms can analyze transaction data in real-time, identifying anomalies that signal potential fraud. This proactive approach safeguards both members and the institution’s integrity.

- Member Insights and Personalization: AI analyzes member behavior, preferences, and transaction histories, offering credit unions and banks insights to personalize services, enhancing member engagement and loyalty.

- AI-Powered Chatbots and Virtual Assistant: Implementing AI-driven chatbots in call centers revolutionizes customer support. These virtual agents are available 24/7, offering prompt responses to routine inquiries.

Assessing Readiness and Resources: Preparing for AI Adoption

- Data Infrastructure: Evaluate your institution’s data capabilities. Effective AI relies on quality data, so ensure that data collection and management processes are robust.

- Budget Considerations: AI implementation involves costs, including software, hardware, and staff training. Set a realistic budget that aligns with your institution’s goals, as this is something that you definitely don’t want to skimp out on.

- Staff Training: AI introduces new technologies and processes. Ensure your staff receives adequate training to leverage AI tools effectively.

Choosing the Right AI Solutions: Tailored to Your Needs

- Identify Goals: ‘AI’ can be a very broad term, and the types of solutions that fall under that category can be quite wide and confusing if you’re just starting your search. Determine what you aim to achieve with AI. Whether it’s improving member experiences, streamlining operations, or enhancing security, align your AI strategy with your institution’s goals.

- Vendor Evaluation: Research AI solution providers that specialize in the community financial institution space. Consider factors such as experience, reputation, and compatibility with your existing systems.

- Scalability: Choose solutions that can grow alongside your institution. Scalability ensures that your AI initiatives can accommodate increased demand and expanded services.

Piloting and Implementing AI: Gradual Steps for Success

- Start Small: When it comes to implementing AI in the most effective ways, community financial institutions don’t need to eat the whole pie in one sitting; you just need a slice. Begin with pilot projects focused on specific areas. For instance, implement a chatbot for basic member inquiries before expanding its capabilities.

- Data Gathering: Collect data from your AI initiatives and analyze the results. Assess performance metrics and member feedback to fine-tune your AI systems.

- Feedback Loop: Encourage staff and member feedback. This ongoing loop of input helps you identify areas for improvement and make necessary adjustments.

Measuring Success and Continuous Improvement: Iterative Enhancement

- Establish Key Performance Indicators (KPIs): Setting goals in an imperative strategic stepping stone for being able to determine whether or not a software does what you want it to. Define KPIs that align with your institution’s objectives, such as improved member satisfaction scores, reduced call center wait times, or increased cross-selling rates.

- Monitor Progress: Regularly track and analyze your AI initiatives’ performance against established KPIs. Adjust strategies based on the insights gained from this monitoring.

- Adapt and Evolve: AI is not static; it evolves with technology and member needs. Stay updated on industry trends and innovations to ensure your AI strategies remain effective.

In conclusion, navigating the AI landscape is a strategic journey that holds immense potential for credit unions, community banks, and their call centers. By understanding AI’s basics, identifying opportunities, assessing readiness, and gradually implementing AI initiatives, institutions can harness the power of AI to enhance member experiences, streamline operations, and secure a competitive edge in the dynamic financial industry.

As AI continues to evolve, credit unions and banks that embrace these transformative technologies are poised to lead the way into the future of finance.