- Marketing

Laura Re

Director of Product Marketing

- October 2025

Nandita Verma

VP of Marketing

- Customer Success

- October 2025

Subhra Bhattacharya

Sr. Director, Customer Success

- Customer Success

- October 2025

Kaitlin Ramos

Director, Customer Success

- September 2025

Saahil Kamath

VP of Products

- September 2025

Saahil Kamath

VP of Products

Product Release Highlights

Smarter Queue Management with Channel-Specific Timeouts

October 2025

Set channel-specific timeout durations for Voice, Chat, Text, and Video, preventing missed calls and optimizing queue behavior for each interaction type.

Click Here ->

Direct Extension Dialing for Office Phone Users

October 2025

Enable direct extension dialing from your IVR, connecting consumers instantly to back-office staff without agent assistance.

Click Here ->

Branded Outbound Calling with Configurable Caller ID

October 2025

Configure branded outbound caller ID for each Office Phone user, ensuring every external call displays your institution’s identity while maintaining granular permission controls.

Click Here ->

Branch-Specific E911 Routing for Employee Safety

October 2025

Ensure employee safety and regulatory compliance with branch-specific E911 routing that directs emergency responders to the correct physical location.

Click Here ->

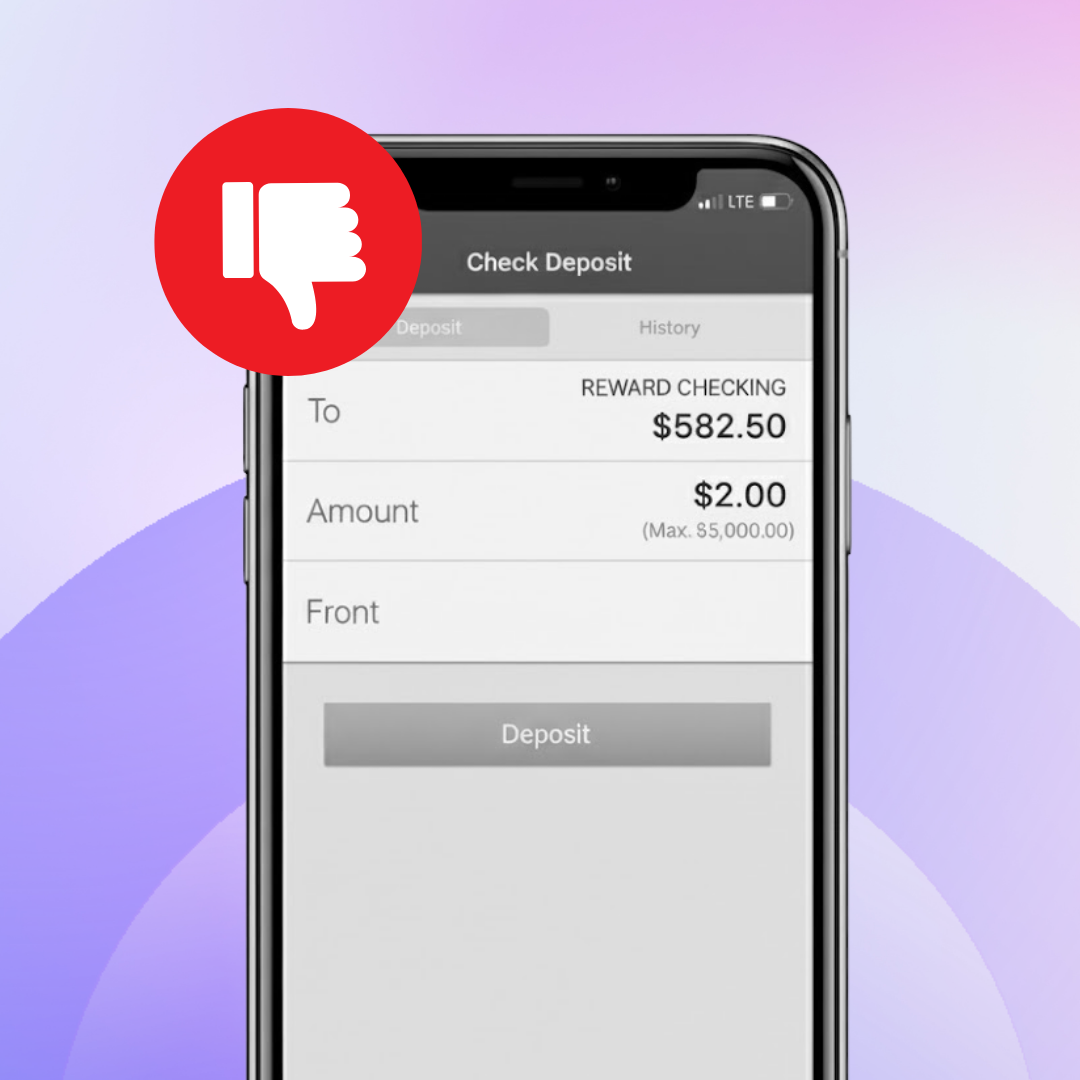

Release Check-Ins Back to the Queue

October 2025

Maintain service continuity by releasing check-ins back to the queue when agents become unavailable, eliminating unnecessary cancellations and reducing consumer frustration.

Click Here ->

Balance Appointments and Walk-Ins with Staff Thresholds

October 2025

Balance appointments and walk-ins by auto-hiding slots when staff availability falls below your set threshold.

Click Here ->

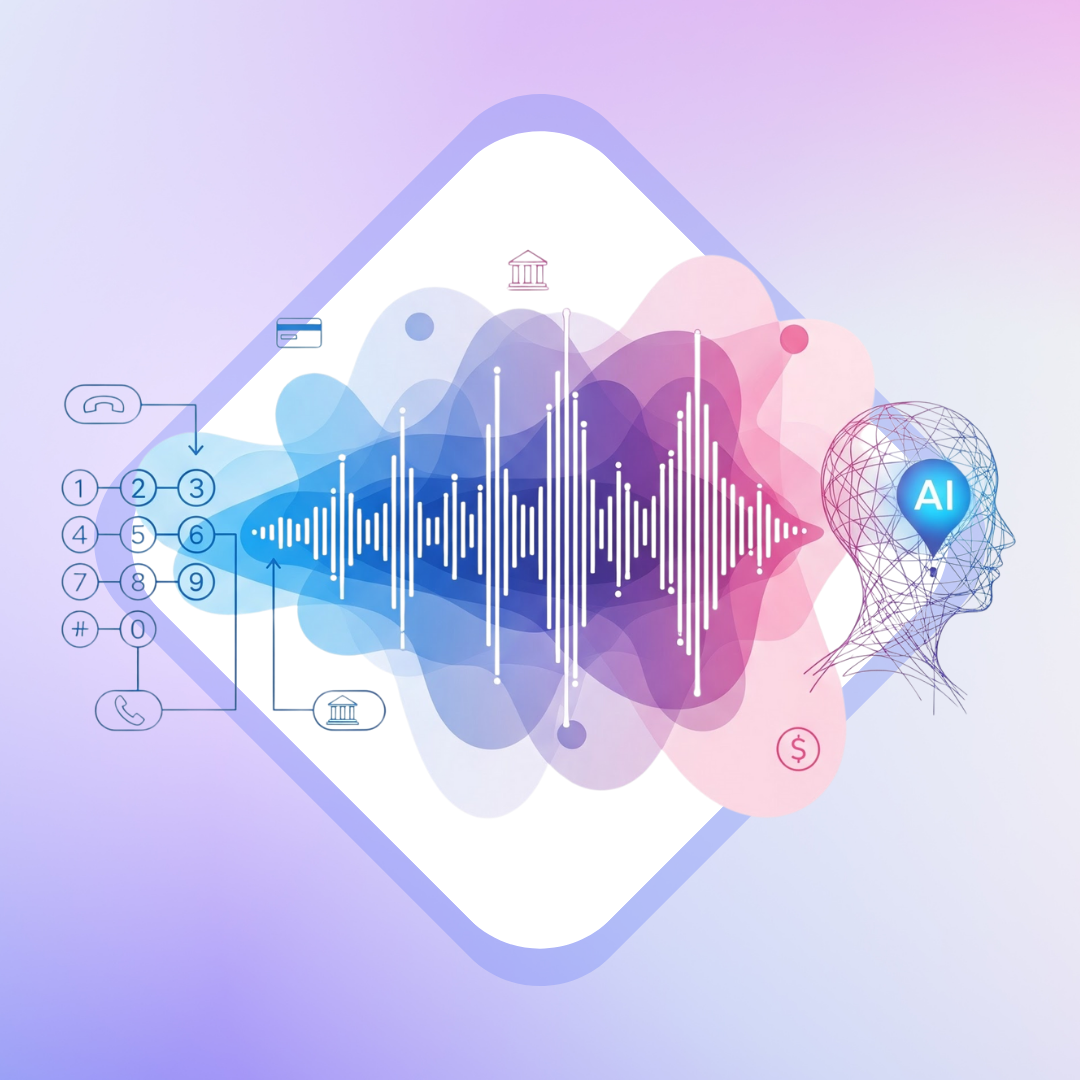

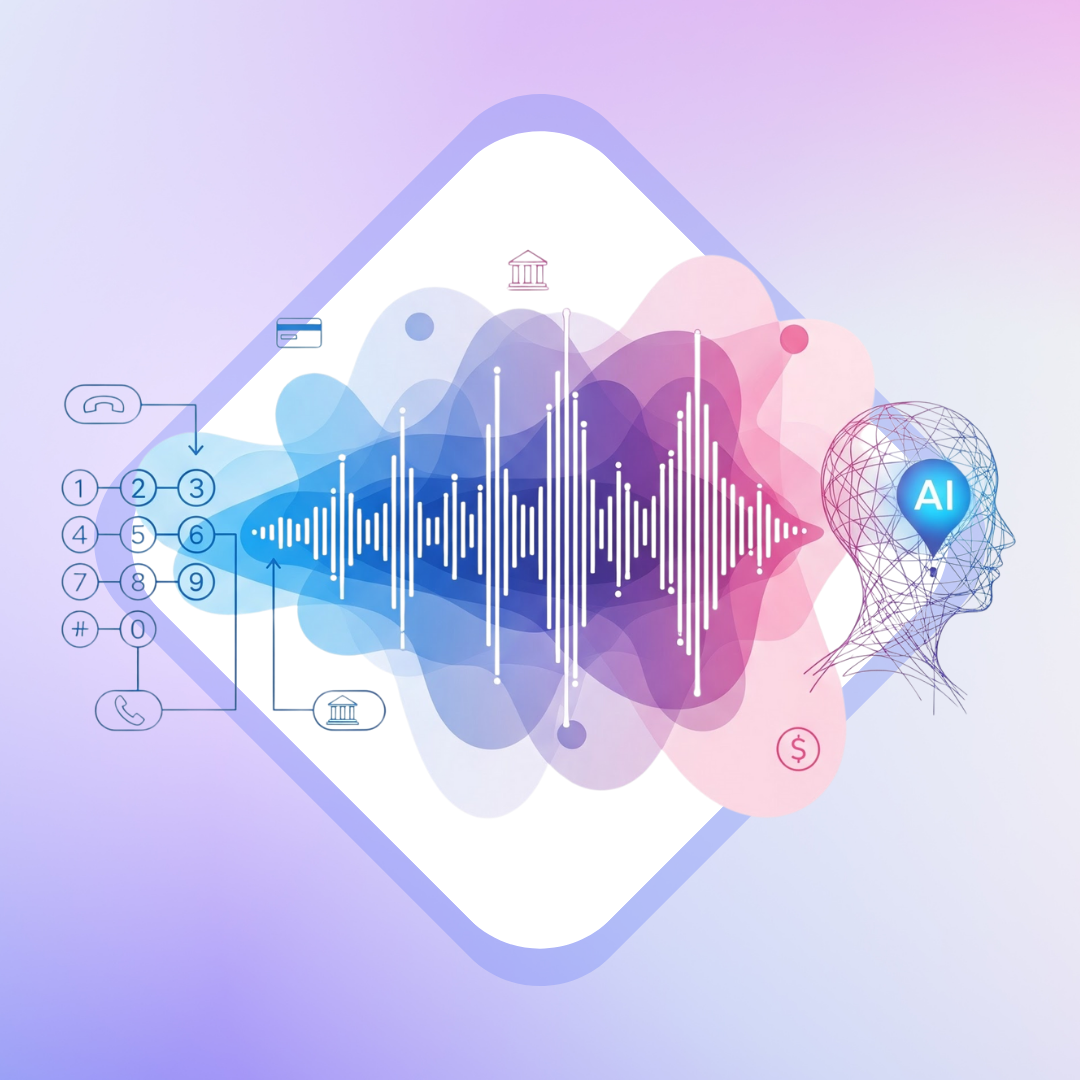

Smarter Transfers and Authentication Visibility in AI Voice Agents

October 2025

AI Voice Agents now show authentication status upfront, intercept transfers to boost self-service, and route flagged calls to the right department automatically.

Click Here ->

A More Natural, Face-to-Face Video Experience

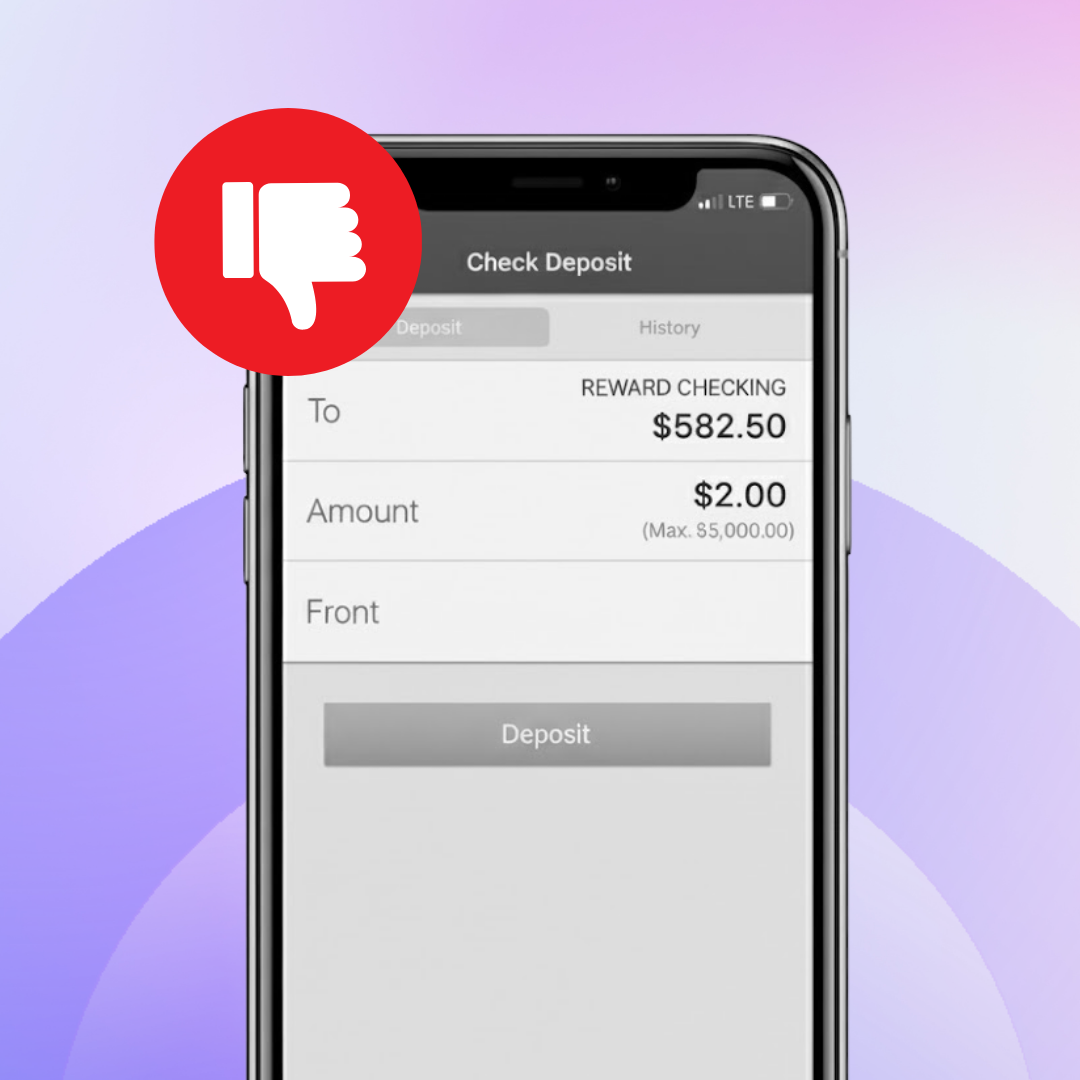

Multi-File Uploads for Each Category Made Easy

- October 2025

Brian Beach

Account Executive

- October 2025

Praveen Konda

Product Manager

- September 2025

Ashutosh Dubey

Product Manager

- September 2025

Cindy Brochu

Senior Product Marketing Manager

- September 2025

Amir Tajkarimi

Head, Collections Business Unit

- August 2025

Pramod Manjunath

Product Manager

- August 2025

Cindy Brochu

Senior Product Marketing Manager

- July 2025

Cindy Brochu

Senior Product Marketing Manager

- July 2025

Aneesh Ballabh

Associate Product Manager

- November 2023

Ashish Garg

Co-founder & CEO

- September 2025

Saahil Kamath

VP of Products

- September 2025

Saahil Kamath

VP of Products

- September 2025

Saahil Kamath

VP of Products

- December 2024

Saahil Kamath

VP of Products

- April 2025

Ashish Garg

Co-founder & CEO

- July 2025

Saahil Kamath

VP of Products

- July 2025

Michel Jamati

Head of Engineering, Collections BU

- July 2025

Aneesh Ballabh

Associate Product Manager

- July 2025

Cindy Brochu

Senior Product Marketing Manager

- August 2025

Cindy Brochu

Senior Product Marketing Manager

- August 2025

Pramod Manjunath

Product Manager

- September 2025

Amir Tajkarimi

Head, Collections Business Unit

- September 2025

Cindy Brochu

Senior Product Marketing Manager

- September 2025

Ashutosh Dubey

Product Manager

- October 2025

Praveen Konda

Product Manager

- October 2025

Brian Beach

Account Executive

- Engineering

- July 2025

Utkarsh Shankar

Product Manager

- June 2025

Ashish Garg

Co-founder & CEO

- November 2023

Ashish Garg

Co-founder & CEO

- March 2023

Ashish Garg

Co-founder & CEO

- May 2023

Ashish Garg

Co-founder & CEO

- August 2023

Ashish Garg

Co-founder & CEO

- Customer Success

- October 2025

Subhra Bhattacharya

Sr. Director, Customer Success

- Customer Success

- October 2025

Kaitlin Ramos

Director, Customer Success

- November 2025

Laura Re

Director of Product Marketing

- October 2025

Nandita Verma

VP of Marketing

Subscribe to Eltropy Labs – Be the First to What’s Next

The latest insights, ideas, and innovations delivered straight to your inbox.

Subscribe to Eltropy Foundry

The latest insights, ideas, and innovations delivered straight to your inbox.

Want to see Eltropy in action?

Book a personalized demo and see how we help CFIs do more with less.

Book a Demo ->

Inspired by this action? Join our team.

Help us make top-tier financial products and services accessible anytime, anywhere.

Subscribe to the Eltropy Blog

Inspired by this post? Join our team.

Help us make top-tier financial products and services accessible anytime, anywhere.

Want to see Eltropy in action?

Book a personalized demo and see how we help CFIs do more with less.