Have you noticed the lines getting longer in your local grocery store’s “Express lane with 10 items or less”?

It may be hard to believe it’s been ten years, but in 2003, Home Depot introduced self-checkouts and changing retail industry forever. Self-checkouts made shopping more convenient for customers and allowed retailers to redeploy associates to the sales floor. The concept of “omnichannel” (providing a seamless experience across all channels) has gained traction since then, particularly in the retail and online commerce industries.

Around 2010, “omnichannel banking” got rolling as customers began demanding more convenient and flexible banking options. Since the rise of digital technologies, bank customers have been wanting and expecting their banking services online, on mobile devices, and in person when needed. Banks have responded, for the most part, by recognizing the need to integrate these channels with their traditional branches, ATMs, and call centers — creating a truly omnichannel banking experience.

Omnichannel in credit unions

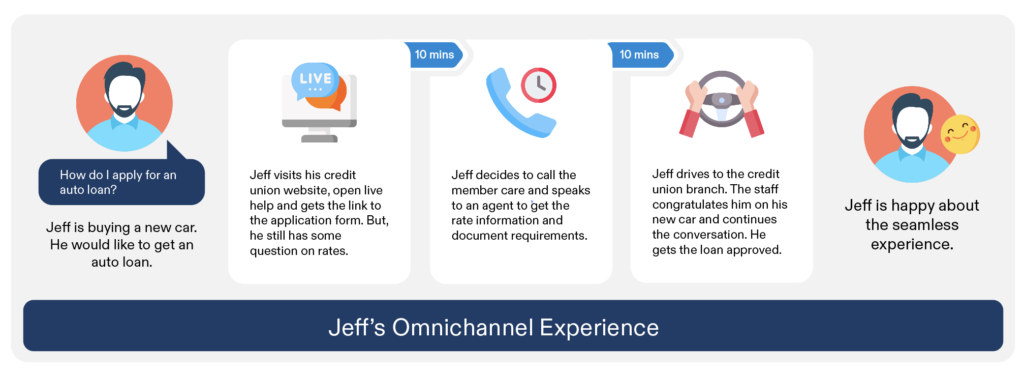

In an ideal omnichannel system, all channels are connected and work together in a coordinated manner. Credit union members, for example, can start a loan application on a digital channel and finish the process in-branch — without disruption.

For example, a member may start a chat session on a credit union website, continue the conversation over the phone or through email, and then the contact center agent will have access to the entire conversation history and member information.

This involves integrating different systems and technologies, such as an Interactive Voice Response (IVR) system, customer relationship management (CRM) software, automatic call distribution (ACD) system, core banking system and chat platforms — to provide a unified view of the customer and their interactions with the credit union staff.

Multi-channel to Omnichannel

To truly understand how this works, however, one must understand the clear distinctions between multichannel and omnichannel experiences. Most credit unions invest heavily in multichannel support — as opposed to a true omnichannel. Let me explain.

In a traditional multichannel model, your members can either text, chat or call you with requests. Each request to the member care team or the credit union staff is an independent request. The front and back-office systems are not sufficiently connected to (1) proactively identify the reason for your call, (2) provide you a status on the next action and (3) transfer you to the same agent for continuity in conversation.

It’s clear then why a multichannel system can be limiting, even though it does provide flexibility of channel options to reach the credit union. The lack of consistency across the messaging channels is a huge problem.

In an omnichannel model, on the other hand, the systems are connected and working together. The member interaction is seamless. No need for a credit union member to restart the request from the beginning every time they’re connected to a new agent.

Omnichannel, then, is the experience that truly offers convenience, flexibility and quick resolution.

| InTouch Credit Union, a Plano-Texas based credit union, takes its omnichannel experience seriously. InTouch allows members to interact wherever, whenever via text, live chat and voice. Members can get instant service from routine queries, follow up on loans to speaking with an agent. |

| Chelsea Groton Bank in Connecticut has taken the omnichannel experience to the next level. ChelseaLIVE offers account opening through video calls; customers can also transfer funds, open accounts, make loan payments, and so much more. |

Read the next post in this series here: Cracking the code: Understanding intent from conversations