Co-browse from chat, video, phone, and text conversations to see what members and customers are seeing on their screens.

Co-browsing Designed for Enterprise

No Downloads

- Unlike screen sharing, Co-browse doesn’t require any downloads on the users device.

- Only the browser tab is shared with the agent, eliminating the need for screen streaming.

Field Masking and Form Restrictions

- Prevent agents from seeing sensitive data like social security numbers by masking specific fields on any page of your site. Masked field data is not shown to agents.

- Configure Co-browse to prevent agents from submitting forms, ensuring that only members and customers can complete and submit the forms.

Audit Logs

- View all agents’ actions within any timeframe to easily track and hold agents accountable.

- If issues arise, quickly trace back to an agent’s specific actions using audit logs.

Secure Surfing

- Eltropy Co-browse employs TLS 1.3 transport security and uses strong SHA-256 SSL encryption for data in transit.

- All sessions are initiated with a secure web connection, deployed with a secure-first approach, and monitored 24/7.

Data & Privacy

- A Co-browse session exists within a single browser tab, sharing only the content members and customers choose to show on co-browse.

- It never shares the entire screen or any other data on the computer.

- Eltropy does not store any personal information or session data on disk, and PII data and cookies never leave the device.

On a scale of 1-10, the competitors we saw might’ve been a 5, and Eltropy Platform was a 10+. For us, it was so easy to use, we just turned it on and were off and running.

Pete VanGraafeilandSVP, Member Services

Whether it's a new user we're introducing to the platform or an old user who's learning new features, we all agree that Eltropy has been such an easy platform for our team to use. It’s so intuitive.

Sean ChambersChief Operating Officer

Eltropy helped us digitally connect members with branch, lending, collection, and contact center associates using one singular solution across all channels.

Kent LugrandPresident & CEO Experience The Unified Impact

Go beyond piecemeal solutions that lack clear impact and drive real value through increased satisfaction, employee productivity, revenue and retention, all at scale.

$3.7 M

Overall drop in delinquency from December 2023 to March 2024

(Alltru Credit Union)

300%

Faster member authentication 45 Seconds to authenticate

(Idaho Central Credit Union)

20%

Faster lending process, 3 days reduction in loan approval time

(Patelco Credit Union)

40X

Higher response rate with Text than other modes of communication

(Family Savings CU)

60%

Increase in number of accounts opened with In-branch Video

(Xplore Federal Credit Union)

95%

Reduction in loan approval times, application completion <10 mins

(Natco Credit Union)

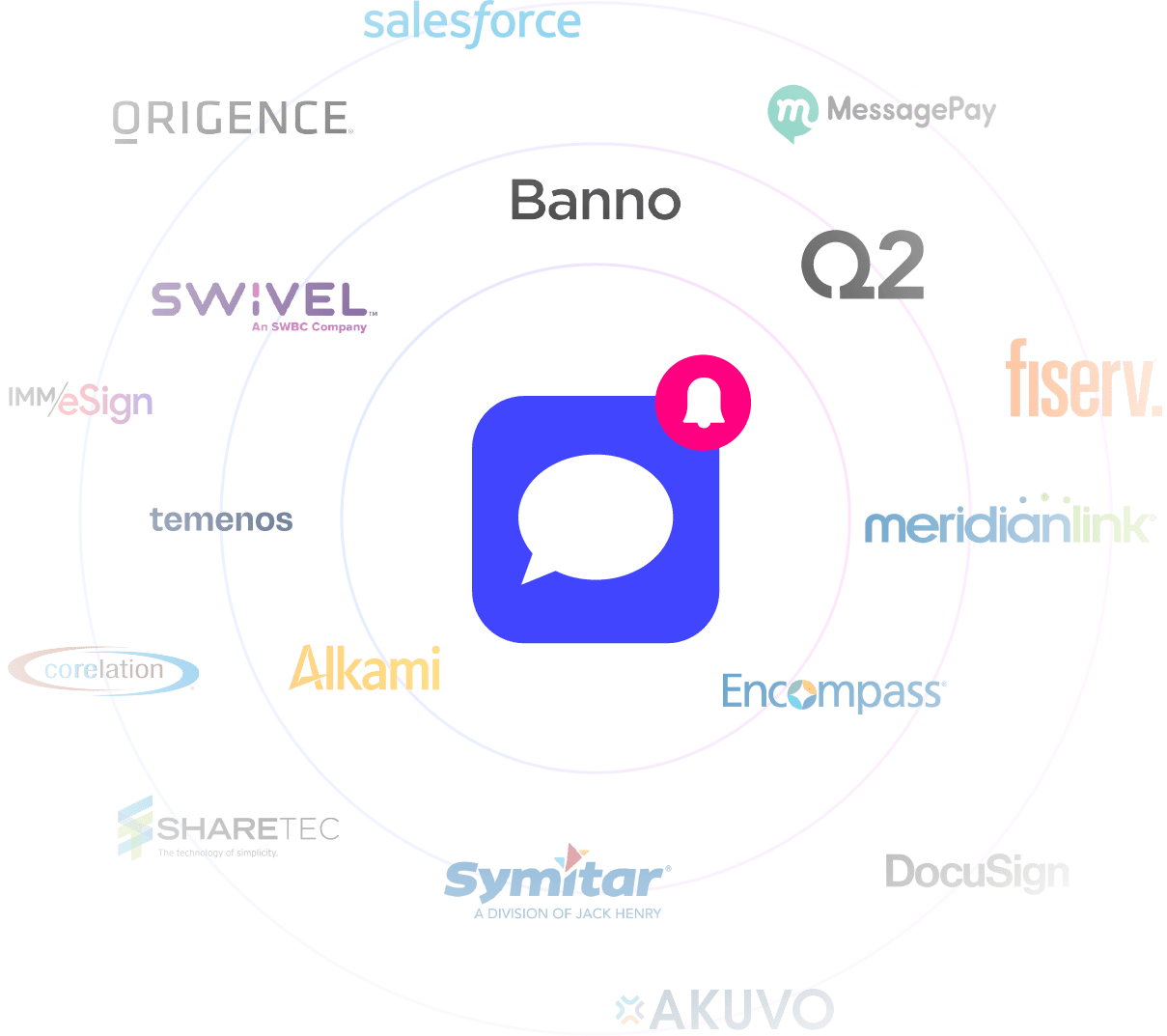

Integrated Tech Stack

Connect with an extensive network of leading technology vendors catering to community financial institutions such as Core systems, CRM, LOS, AOS, Collections, and other essential providers.