CUSTOMER VOICES

Our North Stars

Our customer stories do more than inspire – they carve the way for a financial future where everyone has access to financial capital anytime, anywhere.

“Video Banking has taken digital services to the next level. What we do with Eltropy’s video solution is offer a full branch experience to our members.”

Sarah Kuesel

Senior Manager

“Being able to use the system in the same way across departments—whether it’s lending, collections, or the contact center—has been a game changer. Everybody absolutely loves the system. It’s very intuitive and easy to use.”

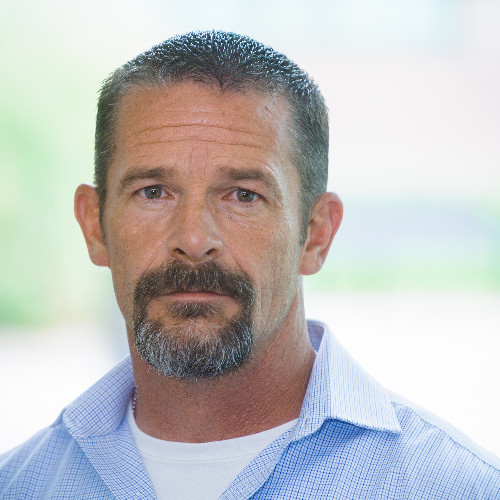

Nik Dokic

Business Analyst/Project Manager

“It was like walking up to a window, but I didnʼt leave my home! Perfect to allow me to keep banking with Clearview since I moved out of the state.”

Lynn

Clearview Live® User

“We all know wire fraud has been on the rise. The video banking platform allows us to visually identify all of our customers who want to perform a wire transfer, thus basically eliminating the chance of wire fraud.”

Maria Nephew

AVP of Virtual Banking Manager

“If you can dream it, Eltropy can probably make it. The amazing thing with the Eltropy team is there has not been one thing that we’ve thought up or had an idea of where they have said, “No, we can’t do it”. It’s always been, “oh, we’ve already thought of that” 90% of the time, and the 10% that it hasn’t been, “it’s that’s a great idea. We’ll start talking about that internally and see when we can push that into production and make it tangible.”

Eryka Ragsdale

VP of Member Services

“If a customer lives out of the area or says that they have trouble getting into the branch, it’s no problem. We refer them in a minute to the video channel, where we can assist customers from all segments, be it a deposit, something loan-related, or whatever they need. Customers can get personalized service from their trusted banker, and they can do it from anywhere, even in the UK or Europe.”

Donna Driscoll

VP Branch Administration

“We now have more channels to communicate with our members. Texting has been effective from a collections perspective when reaching out to contact members. We’re also rolling out texting for our lending and branch teams, which will support loan closings and account openings. Members now text us instead of waiting on hold, and we’ve seen an increase in automation and self-serve options.”

Eryka Ragsdale

VP of Member Services

“You can tell Eltropy cares about us, and they really are all about listening to us. When there’s something in the system that maybe doesn’t fit our needs, they’ll try to understand the why behind it and actually do something about it.”

Melissa Wrycha

Chief Experience Officer

“From a product standpoint, I really believe in Eltropy products and they are effective. They have that ‘it factor’ that many other organizations strive for but haven’t quite been able to put their thumb on it.”

Eryka Ragsdale

VP of Member Services

“I work with about almost 20 different vendors across the credit union. Working with Eltropy has been in my top three – the whole time from the implementation to now and the after-hours support. So, if any other CFI is looking into implementing any kind of a texting solution, that’s the vendor.”

Nik Dokic

Business Analyst/Project Manager

“Everybody knows how to use their cell phone. Having the ability to text someone and offer assistance has been a game changer. We can send them a link to our loan extension request via Text to get the conversation flowing.”

Leticia Amado

VP of Collections

“Time is one of our most precious resources, and this tool will allow our customers to manage and use their time more effectively. They can now hop on a call and resolve their banking needs in just a few minutes.”

Donna Driscoll

VP Branch Administration

“The generative AI solution from Eltropy gives our employees information right at their fingertips. It helps us achieve first call resolution more often because our contact center staff don’t have to chase down info or follow up repeatedly with members.”

Brad Shafton

SVP, IT & Digital

“We scaled our outreach as delinquencies increased, without having to add new staff. That’s been crucial to keeping us efficient.”

Lilly Megias

COO

“Within three months of implementing Eltropy, we saw a huge drop in delinquencies. When I saw the numbers, I almost couldn’t believe it. It was mind-blowing – We knew we made the right choice.”

Katie Bendyk

Director of eServices & Payment Solutions

“The Friday text reminder is where we see the most payments. Members often tell us it’s convenient for them to get the reminder right before the weekend.”

Cynthia Moreno

Collections Officer

“The moment we sent out the first campaign, we started taking payments right away. It was just amazing. The receptivity from the member base was automatic. It’s not embarrassing… [members] just click here, they execute the transaction, 1-2-3, and it’s done.

Our collections manager has been amazed. When you see the numbers out of the gate in the first month, you realize how much of a difference it makes. Eltropy allows us to handle the low-hanging fruit while our team focuses on more complex transactions.”

Anthony Mero

CEO

“The way MeridianLink and Eltropy work together has been remarkable. We’re seeing loan officers close deals faster because they can text right from within the loan file. When a member needs to submit additional documentation or sign something, our team can send a quick text and often get a response within minutes rather than days. The efficiency gains have been incredible.”

Tony Sanches

VP of Lending

“Bringing in Video Banking has proven immensely successful in not only reducing wait times at our busiest branches but also efficiently addressing staffing needs at our remote locations.”

Jeremy Deamer

Branch Technology & Innovation Manager

“It’s really been a lifeline for our branches, especially during Covid when it was a struggle to keep branches open. Since then we’ve even found that more and more members prefer doing business with us this way!”

Jeremy Deamer

Branch Technology & Innovation Manager

“The product is truly amazing. The ease of connecting with members, sharing screens and documents during conversations, and guiding them through website difficulties with screen sharing has been a game changer. “

Iwona Leatherberry

Digital Banking Manager

“From day one, Eltropy’s leadership team actively listened to our specific requests, demonstrating their remarkable receptiveness and adaptability. They seamlessly accommodated all our needs, allowing us to test functionalities in a demo environment and promptly addressing our questions.”

Iwona Leatherberry

Digital Banking Manager

“We saw a significant drop in routine calls, allowing our associates to focus on deeper, more meaningful conversations with members instead of handling basic self-service inquiries.”

Brandy Roy

VP of Information Technology

“After using Eltropy Texting for five years, we’ve been slowly turning on each of the features over the past year. We’ve been doing In-Branch Video for about seven months and started using Eltropy’s Appointment Management and Chat for about nine months now. And we started using bank from anywhere just recently. So far it’s been fantastic.”

Melissa Wrycha

Chief Experience Officer

“With Eltropy, we were able to offer our members convenience and access to be able to do banking when they want to do their banking, not when we want them to do their banking.”

Carmen Sanchez

VP of Virtual Delivery

“With Eltropy, we’ve discovered just how much our credit union can do. We’ve found services we didn’t even know we had, and we’re training our teams to do new things. It’s really expanding what we can offer our members.”

Joshua Paredes

VP of Member Experience

“Introducing the Eltropy system to our E-Services team who do all our online account opening, collections team, and now our contact center, has really helped our operations. Texting is the way people communicate in today’s world. It’s fast, it’s efficient, it’s easy.”

Mary Burruel

VP of Project Management

“We saw roughly a 20% decrease in calls almost right out of the gate, and by the time we got Ruth into digital banking, it was significant.”

Jill Schaffler

SVP of Enterprise Applications

“MeridianLink and Eltropy coming together under one platform is like having your right hand and left hand working at the same speed, on the same page, in the same book. It was our top priority at Natco to make this integration successful and Eltropy made it really simple.”

Kimberley Davis

Branch Manager

“Eltropy is a great partnership for Sharetec because it allows our Credit Unions the power to connect with their members and stay competitive in a world where quick service is so important. This platform is easy to use and comes with so many benefits: workflows, automations, compliance and security all in one.”

Carrie Heck

Senior Account Executive

“In one year on the Eltropy platform, Video Banking became our top channel for account and loan originations. Since we require non-branch wires to be verified over Video Banking, our number of incidents of fraudsters impersonating our members has decreased to zero.”

Ron Winter

CTO

“Pandemic or not, 70% of our members said they plan to never come back to a branch for their banking needs. Eltropy helped us digitally connect members with branch, lending, collection, and contact center associates using one singular solution across all channels. We evaluated many of the top vendors in this market, and only Eltropy could deliver what we were looking to provide.”

Kent Lugrand

President and CEO

“Eltropy has been a great partner in helping us come up with solutions. The entire Eltropy team was vested in making sure we were successful. I think that’s also the benefit of working with smaller firms who are engaged and really believers in their solution and what they’re selling. The moment we sent out the first campaign, we started taking payments right away. It was just amazing. The receptivity from the member base was automatic. It’s not embarrassing… [members] just click here, they execute the transaction, 1-2-3, and it’s done. Our collections manager has been amazed. When you see the numbers out of the gate in the first month, you realize how much of a difference it makes. Eltropy allows us to handle the low-hanging fruit while our team focuses on more complex transactions.”

Anthony Mero

CEO

“Some collectors don’t like change. But as soon as they started using it, they realized how helpful Texting can be. It’s an easier way to communicate. And the collectors are happy that they can actually make contact with people.”

Leticia Amado

VP of Collections

“Our members who would never pick up our collection’s calls opened up their hearts on Text. I continue to be blown away with how effective Text Messaging is for loss mitigation.”

Shawn Spratte

SVP of Loss Mitigation and Communication Center

“Using Eltropy texting for our Collections and Recovery departments, we’re collecting way more than ever before. By sending delinquent payment reminders with secure payment links, we had a record-breaking collections year in 2021, collecting $48.3 million and recovering $9.9 million in principal from charged-off loans, and we continue to see these positive results year after year.”

Lisa Weinstein

VP of Member Relationship Product Management

“Email is becoming archaic in lending. To stay relevant today, you have to have text messaging capabilities. Without Eltropy, we would be struggling to meet our members’ expectations for modern communication.”

Tony Sanches

VP of Lending

“Texting as a method of communication has been very effective not only in the late-stage collection but also reaching some of our members in the earlier stages of collections. We are very satisfied with this process.”

Bert Jones

Collections Manager

“As soon as we started using Text with Eltropy, we saw an immediate difference in our response rates. We have such high volumes of collections, and the bottom line is that people are more likely to respond to Text.”

Leticia Amado

VP of Collections

“Through our video banking team, we run about 2000 to 3000 video calls per month. We are constantly on calls with engaging with our members from where they need to be.”

Chasmine McIntosh

VP of Digital Banking

“People who never responded before are responding now. It’s like we’ve suddenly started speaking their language, and they’re actually listening. It’s amazing. In my 20 years in the credit union industry, this is the most game-changing innovation I’ve seen.”

Art Sookazian

VP of Special Services

“What Eltropy is doing with its Unified Conversations Platform will only magnify and highlight all the other technology enhancements that we’re currently making for our members across all departments of the organization. In the end, we’re improving our financial and communications technology to help our employees first, so they can in turn help our members have a better banking experience.”

Carter Pope

CEO

“Being on the Eltropy platform makes my heart happy. We sleep well at night knowing our agents are using secure text.”

Jeff Sanders

VP of IT

“Our journey towards digital transformation led us to Eltropy’s AI chat solutions, and we’re starting to see remarkable results. What sets Eltropy apart is not just their technology but also their dedication to understanding the credit union industry and their commitment to community financial institutions like ours. They continue to evolve, and that’s why we consider them a long-term partner, including for AI.”

Brad Shafton

SVP, IT and Digital

“Being on the Eltropy platform makes my heart happy. We sleep well at night knowing our agents are using secure text.”

Jeff Sanders

VP of IT

“People who never responded before are responding now. It’s like we’ve suddenly started speaking their language, and they’re actually listening. It’s amazing. In my 20 years in the credit union industry, this is the most game-changing innovation I’ve seen.”

Art Sookazian

VP of Special Services

“As soon as we started using Text with Eltropy, we saw an immediate difference in our response rates. We have such high volumes of collections, and the bottom line is that people are more likely to respond to Text.”

Leticia Amado

VP of Collections

“Texting as a method of communication has been very effective not only in the late-stage collection but also reaching some of our members in the earlier stages of collections. We are very satisfied with this process.”

Bert Jones

Collections Manager

“Email is becoming archaic in lending. To stay relevant today, you have to have text messaging capabilities. Without Eltropy, we would be struggling to meet our members’ expectations for modern communication.”

Tony Sanches

VP of Lending

“Using Eltropy texting for our Collections and Recovery departments, we’re collecting way more than ever before. By sending delinquent payment reminders with secure payment links, we had a record-breaking collections year in 2021, collecting $48.3 million and recovering $9.9 million in principal from charged-off loans, and we continue to see these positive results year after year.”

Lisa Weinstein

VP of Member Relationship Product Management

“Our members who would never pick up our collection’s calls opened up their hearts on Text. I continue to be blown away with how effective Text Messaging is for loss mitigation.”

Shawn Spratte

SVP of Loss Mitigation and Communication Center

“Some collectors don’t like change. But as soon as they started using it, they realized how helpful Texting can be. It’s an easier way to communicate. And the collectors are happy that they can actually make contact with people.”

Leticia Amado

VP of Collections

“Eltropy has been a great partner in helping us come up with solutions. The entire Eltropy team was vested in making sure we were successful. I think that’s also the benefit of working with smaller firms who are engaged and really believers in their solution and what they’re selling. The moment we sent out the first campaign, we started taking payments right away. It was just amazing. The receptivity from the member base was automatic. It’s not embarrassing… [members] just click here, they execute the transaction, 1-2-3, and it’s done. Our collections manager has been amazed. When you see the numbers out of the gate in the first month, you realize how much of a difference it makes. Eltropy allows us to handle the low-hanging fruit while our team focuses on more complex transactions.”

Anthony Mero

CEO

“Pandemic or not, 70% of our members said they plan to never come back to a branch for their banking needs. Eltropy helped us digitally connect members with branch, lending, collection, and contact center associates using one singular solution across all channels. We evaluated many of the top vendors in this market, and only Eltropy could deliver what we were looking to provide.”

Kent Lugrand

President and CEO

“MeridianLink and Eltropy coming together under one platform is like having your right hand and left hand working at the same speed, on the same page, in the same book. It was our top priority at Natco to make this integration successful and Eltropy made it really simple.”

Kimberley Davis

Branch Manager

“Introducing the Eltropy system to our E-Services team who do all our online account opening, collections team, and now our contact center, has really helped our operations. Texting is the way people communicate in today’s world. It’s fast, it’s efficient, it’s easy.”

Mary Burruel

VP of Project Management

“Within three months of implementing Eltropy, we saw a huge drop in delinquencies. When I saw the numbers, I almost couldn’t believe it. It was mind-blowing – We knew we made the right choice.”

Katie Bendyk

Director of eServices & Payment Solutions

“The way MeridianLink and Eltropy work together has been remarkable. We’re seeing loan officers close deals faster because they can text right from within the loan file. When a member needs to submit additional documentation or sign something, our team can send a quick text and often get a response within minutes rather than days. The efficiency gains have been incredible.”

Tony Sanches

VP of Lending

“Everybody knows how to use their cell phone. Having the ability to text someone and offer assistance has been a game changer. We can send them a link to our loan extension request via Text to get the conversation flowing.”

Leticia Amado

VP of Collections

“Being able to use the system in the same way across departments—whether it’s lending, collections, or the contact center—has been a game changer. Everybody absolutely loves the system. It’s very intuitive and easy to use.”

Nik Dokic

Business Analyst/Project Manager

“If you can dream it, Eltropy can probably make it. The amazing thing with the Eltropy team is there has not been one thing that we’ve thought up or had an idea of where they have said, “No, we can’t do it”. It’s always been, “oh, we’ve already thought of that” 90% of the time, and the 10% that it hasn’t been, “it’s that’s a great idea. We’ll start talking about that internally and see when we can push that into production and make it tangible.”

Eryka Ragsdale

VP of Member Services

“I work with about almost 20 different vendors across the credit union. Working with Eltropy has been in my top three – the whole time from the implementation to now and the after-hours support. So, if any other CFI is looking into implementing any kind of a texting solution, that’s the vendor.”

Nik Dokic

Business Analyst/Project Manager

“The Friday text reminder is where we see the most payments. Members often tell us it’s convenient for them to get the reminder right before the weekend.”

Cynthia Moreno

Collections Officer

“We scaled our outreach as delinquencies increased, without having to add new staff. That’s been crucial to keeping us efficient.”

Lilly Megias

COO

“The moment we sent out the first campaign, we started taking payments right away. It was just amazing. The receptivity from the member base was automatic. It’s not embarrassing… [members] just click here, they execute the transaction, 1-2-3, and it’s done.

Our collections manager has been amazed. When you see the numbers out of the gate in the first month, you realize how much of a difference it makes. Eltropy allows us to handle the low-hanging fruit while our team focuses on more complex transactions.”

Anthony Mero

CEO

“Our journey towards digital transformation led us to Eltropy’s AI chat solutions, and we’re starting to see remarkable results. What sets Eltropy apart is not just their technology but also their dedication to understanding the credit union industry and their commitment to community financial institutions like ours. They continue to evolve, and that’s why we consider them a long-term partner, including for AI.”

Brad Shafton

SVP, IT and Digital

“Being on the Eltropy platform makes my heart happy. We sleep well at night knowing our agents are using secure text.”

Jeff Sanders

VP of IT

“What Eltropy is doing with its Unified Conversations Platform will only magnify and highlight all the other technology enhancements that we’re currently making for our members across all departments of the organization. In the end, we’re improving our financial and communications technology to help our employees first, so they can in turn help our members have a better banking experience.”

Carter Pope

CEO

“Pandemic or not, 70% of our members said they plan to never come back to a branch for their banking needs. Eltropy helped us digitally connect members with branch, lending, collection, and contact center associates using one singular solution across all channels. We evaluated many of the top vendors in this market, and only Eltropy could deliver what we were looking to provide.”

Kent Lugrand

President and CEO

“Eltropy is a great partnership for Sharetec because it allows our Credit Unions the power to connect with their members and stay competitive in a world where quick service is so important. This platform is easy to use and comes with so many benefits: workflows, automations, compliance and security all in one.”

Carrie Heck

Senior Account Executive

“We saw roughly a 20% decrease in calls almost right out of the gate, and by the time we got Ruth into digital banking, it was significant.”

Jill Schaffler

SVP of Enterprise Applications

“Introducing the Eltropy system to our E-Services team who do all our online account opening, collections team, and now our contact center, has really helped our operations. Texting is the way people communicate in today’s world. It’s fast, it’s efficient, it’s easy.”

Mary Burruel

VP of Project Management

“We saw a significant drop in routine calls, allowing our associates to focus on deeper, more meaningful conversations with members instead of handling basic self-service inquiries.”

Brandy Roy

VP of Information Technology

“Being able to use the system in the same way across departments—whether it’s lending, collections, or the contact center—has been a game changer. Everybody absolutely loves the system. It’s very intuitive and easy to use.”

Nik Dokic

Business Analyst/Project Manager

“If you can dream it, Eltropy can probably make it. The amazing thing with the Eltropy team is there has not been one thing that we’ve thought up or had an idea of where they have said, “No, we can’t do it”. It’s always been, “oh, we’ve already thought of that” 90% of the time, and the 10% that it hasn’t been, “it’s that’s a great idea. We’ll start talking about that internally and see when we can push that into production and make it tangible.”

Eryka Ragsdale

VP of Member Services

“We now have more channels to communicate with our members. Texting has been effective from a collections perspective when reaching out to contact members. We’re also rolling out texting for our lending and branch teams, which will support loan closings and account openings. Members now text us instead of waiting on hold, and we’ve seen an increase in automation and self-serve options.”

Eryka Ragsdale

VP of Member Services

“From a product standpoint, I really believe in Eltropy products and they are effective. They have that ‘it factor’ that many other organizations strive for but haven’t quite been able to put their thumb on it.”

Eryka Ragsdale

VP of Member Services

“I work with about almost 20 different vendors across the credit union. Working with Eltropy has been in my top three – the whole time from the implementation to now and the after-hours support. So, if any other CFI is looking into implementing any kind of a texting solution, that’s the vendor.”

Nik Dokic

Business Analyst/Project Manager

“Time is one of our most precious resources, and this tool will allow our customers to manage and use their time more effectively. They can now hop on a call and resolve their banking needs in just a few minutes.”

Donna Driscoll

VP Branch Administration

“The generative AI solution from Eltropy gives our employees information right at their fingertips. It helps us achieve first call resolution more often because our contact center staff don’t have to chase down info or follow up repeatedly with members.”

Brad Shafton

SVP, IT & Digital

“Being on the Eltropy platform makes my heart happy. We sleep well at night knowing our agents are using secure text.”

Jeff Sanders

VP of IT

“Through our video banking team, we run about 2000 to 3000 video calls per month. We are constantly on calls with engaging with our members from where they need to be.”

Chasmine McIntosh

VP of Digital Banking

“Pandemic or not, 70% of our members said they plan to never come back to a branch for their banking needs. Eltropy helped us digitally connect members with branch, lending, collection, and contact center associates using one singular solution across all channels. We evaluated many of the top vendors in this market, and only Eltropy could deliver what we were looking to provide.”

Kent Lugrand

President and CEO

“Introducing the Eltropy system to our E-Services team who do all our online account opening, collections team, and now our contact center, has really helped our operations. Texting is the way people communicate in today’s world. It’s fast, it’s efficient, it’s easy.”

Mary Burruel

VP of Project Management

“With Eltropy, we’ve discovered just how much our credit union can do. We’ve found services we didn’t even know we had, and we’re training our teams to do new things. It’s really expanding what we can offer our members.”

Joshua Paredes

VP of Member Experience

“With Eltropy, we were able to offer our members convenience and access to be able to do banking when they want to do their banking, not when we want them to do their banking.”

Carmen Sanchez

VP of Virtual Delivery

“After using Eltropy Texting for five years, we’ve been slowly turning on each of the features over the past year. We’ve been doing In-Branch Video for about seven months and started using Eltropy’s Appointment Management and Chat for about nine months now. And we started using bank from anywhere just recently. So far it’s been fantastic.”

Melissa Wrycha

Chief Experience Officer

“You can tell Eltropy cares about us, and they really are all about listening to us. When there’s something in the system that maybe doesn’t fit our needs, they’ll try to understand the why behind it and actually do something about it.”

Melissa Wrycha

Chief Experience Officer

“Bringing in Video Banking has proven immensely successful in not only reducing wait times at our busiest branches but also efficiently addressing staffing needs at our remote locations.”

Jeremy Deamer

Branch Technology & Innovation Manager

“It’s really been a lifeline for our branches, especially during Covid when it was a struggle to keep branches open. Since then we’ve even found that more and more members prefer doing business with us this way!”

Jeremy Deamer

Branch Technology & Innovation Manager

“If you can dream it, Eltropy can probably make it. The amazing thing with the Eltropy team is there has not been one thing that we’ve thought up or had an idea of where they have said, “No, we can’t do it”. It’s always been, “oh, we’ve already thought of that” 90% of the time, and the 10% that it hasn’t been, “it’s that’s a great idea. We’ll start talking about that internally and see when we can push that into production and make it tangible.”

Eryka Ragsdale

VP of Member Services

“The product is truly amazing. The ease of connecting with members, sharing screens and documents during conversations, and guiding them through website difficulties with screen sharing has been a game changer. “

Iwona Leatherberry

Digital Banking Manager

“From day one, Eltropy’s leadership team actively listened to our specific requests, demonstrating their remarkable receptiveness and adaptability. They seamlessly accommodated all our needs, allowing us to test functionalities in a demo environment and promptly addressing our questions.”

Iwona Leatherberry

Digital Banking Manager

“Video Banking has taken digital services to the next level. What we do with Eltropy’s video solution is offer a full branch experience to our members.”

Sarah Kuesel

Senior Manager

“It was like walking up to a window, but I didnʼt leave my home! Perfect to allow me to keep banking with Clearview since I moved out of the state.”

Lynn

Clearview Live® User

“If a customer lives out of the area or says that they have trouble getting into the branch, it’s no problem. We refer them in a minute to the video channel, where we can assist customers from all segments, be it a deposit, something loan-related, or whatever they need. Customers can get personalized service from their trusted banker, and they can do it from anywhere, even in the UK or Europe.”

Donna Driscoll

VP Branch Administration

“Being on the Eltropy platform makes my heart happy. We sleep well at night knowing our agents are using secure text.”

Jeff Sanders

VP of IT

“As soon as we started using Text with Eltropy, we saw an immediate difference in our response rates. We have such high volumes of collections, and the bottom line is that people are more likely to respond to Text.”

Leticia Amado

VP of Collections

“Using Eltropy texting for our Collections and Recovery departments, we’re collecting way more than ever before. By sending delinquent payment reminders with secure payment links, we had a record-breaking collections year in 2021, collecting $48.3 million and recovering $9.9 million in principal from charged-off loans, and we continue to see these positive results year after year.”

Lisa Weinstein

VP of Member Relationship Product Management

“Some collectors don’t like change. But as soon as they started using it, they realized how helpful Texting can be. It’s an easier way to communicate. And the collectors are happy that they can actually make contact with people.”

Leticia Amado

VP of Collections

“Eltropy has been a great partner in helping us come up with solutions. The entire Eltropy team was vested in making sure we were successful. I think that’s also the benefit of working with smaller firms who are engaged and really believers in their solution and what they’re selling. The moment we sent out the first campaign, we started taking payments right away. It was just amazing. The receptivity from the member base was automatic. It’s not embarrassing… [members] just click here, they execute the transaction, 1-2-3, and it’s done. Our collections manager has been amazed. When you see the numbers out of the gate in the first month, you realize how much of a difference it makes. Eltropy allows us to handle the low-hanging fruit while our team focuses on more complex transactions.”

Anthony Mero

CEO

“We scaled our outreach as delinquencies increased, without having to add new staff. That’s been crucial to keeping us efficient.”

Lilly Megias

COO

“Within three months of implementing Eltropy, we saw a huge drop in delinquencies. When I saw the numbers, I almost couldn’t believe it. It was mind-blowing – We knew we made the right choice.”

Katie Bendyk

Director of eServices & Payment Solutions

“In one year on the Eltropy platform, Video Banking became our top channel for account and loan originations. Since we require non-branch wires to be verified over Video Banking, our number of incidents of fraudsters impersonating our members has decreased to zero.”

Ron Winter

CTO

“We all know wire fraud has been on the rise. The video banking platform allows us to visually identify all of our customers who want to perform a wire transfer, thus basically eliminating the chance of wire fraud.”

Maria Nephew

AVP of Virtual Banking Manager

“Being able to use the system in the same way across departments—whether it’s lending, collections, or the contact center—has been a game changer. Everybody absolutely loves the system. It’s very intuitive and easy to use.”

Nik Dokic

Business Analyst/Project Manager

“We can’t wait to utilize the Eltropy offerings at an even higher level. Having so many options to seamlessly switch from one method of communication to another is exciting!”

Iwona Leatherberry

Digital Banking Manager

“I can’t tell you how many times I had staff come up to me saying, ‘Oh, my God, you made my life so much easier, and now I can multitask and contact various members all throughout the day.’ That was my aha moment – Eltropy’s One Platform is truly paying off for us.”

Sean Manion

VP of Lending

“Honestly, it’s been the best vendor relationship I’ve ever experienced. From the start, they laid everything out clearly, and every wish list item we had was clearly outlined. If something wasn’t on the roadmap, we put it there—something no other competitor was able to do.”

Eryka Ragsdale

VP of Member Services

“The Eltropy platform itself has really helped us have that next level of communication with our members. Having the speed and the ability to have a quick conversation with our members takes our operations to the next level.”

Ken Barr

Director of Marketing

“We now have more channels to communicate with our members. Texting has been effective from a collections perspective when reaching out to contact members. We’re also rolling out texting for our lending and branch teams, which will support loan closings and account openings. Members now text us instead of waiting on hold, and we’ve seen an increase in automation and self-serve options.”

Eryka Ragsdale

VP of Member Services

“Being able to use the system in the same way across departments—whether it’s lending, collections, or the contact center—has been a game changer. Everybody absolutely loves the system. It’s very intuitive and easy to use.”

Nik Dokic

Business Analyst/Project Manager

“The unified platform is so helpful to my team. We can start a conversation in one place and continue it somewhere else. Even if we have to go reach out to somebody else for an answer, at least they can see that we’re working on their problem, and we just haven’t put them into a black hole.”

Howard Meller

President & CEO

“With Eltropy, we’ve discovered just how much our credit union can do. We’ve found services we didn’t even know we had, and we’re training our teams to do new things. It’s really expanding what we can offer our members.”

Joshua Paredes

VP of Member Experience

“What Eltropy is doing with its Unified Conversations Platform will only magnify and highlight all the other technology enhancements that we’re currently making for our members across all departments of the organization. In the end, we’re improving our financial and communications technology to help our employees first, so they can in turn help our members have a better banking experience.”

Carter Pope

CEO

“I think it can’t hurt to try it, just because of the fact that your staff will control how much it’s really used by promoting the product, and then also actually utilizing it.”

Colin Poe

Business Development Manager

“Eltropy is a forward thinker, and we loved their vision. They’re helping us automate processes and improve the member experience on the back end. We’re truly taking care of our members on a platform that lets us do it efficiently and effectively—and we leave our members saying, wow.”

Buddy Bennett

Chief Operating Officer

“Having a unified platform really helps that employee experience. It gives them one screen to go to communicate with our members, whether it’s coming in via Chat, Text Message, whatever it may be. It gives the employee that one pane of glass to really simplify the entire process and make their day-to-day a lot easier.”

Brad Shafton

SVP, IT & Digital

“What I love about Eltropy is that it’s about a partnership. They really want to partner with community financial institutions and credit unions to bring forward what we really need. They listen to us, they partner with us, and it’s collaborative. It’s not just a product, but a partnership.”

Brad Shafton

SVP, IT & Digital

“What I like best about Eltropy is the CSM support. Whenever I have a question or get stuck, or even when I have a new idea for how to use the system, I can reach out and get a response within an hour. If we can’t resolve something over text, we just jump on a quick Zoom call. Any issues we’ve had have been resolved the same day. It’s been the best integration we’ve had with any of our vendors.”

Nik Dokic

Business Analyst/Project Manager

“I’ve never seen as many member compliments as we’ve received this year with Eltropy. I don’t recall seeing that prior to all of the other tech stack that we’ve implemented.”

Fred Perez

SVP, Chief Lending Officer

“Voice+ will make a big difference in how we serve our members. Our agents can now use voice alongside text, video, co-browsing, and AI help. This means we can solve problems faster and better, all in one place. It’s a real improvement for our members.”

Howie Meller

President and CEO

“Our journey towards digital transformation led us to Eltropy’s AI chat solutions, and we’re starting to see remarkable results. What sets Eltropy apart is not just their technology but also their dedication to understanding the credit union industry and their commitment to community financial institutions like ours. They continue to evolve, and that’s why we consider them a long-term partner, including for AI.”

Brad Shafton

SVP, IT and Digital

“Being on the Eltropy platform makes my heart happy. We sleep well at night knowing our agents are using secure text.”

Jeff Sanders

VP of IT

“What Eltropy is doing with its Unified Conversations Platform will only magnify and highlight all the other technology enhancements that we’re currently making for our members across all departments of the organization. In the end, we’re improving our financial and communications technology to help our employees first, so they can in turn help our members have a better banking experience.”

Carter Pope

CEO

“People who never responded before are responding now. It’s like we’ve suddenly started speaking their language, and they’re actually listening. It’s amazing. In my 20 years in the credit union industry, this is the most game-changing innovation I’ve seen.”

Art Sookazian

VP of Special Services

“The adoption by the members has been quick and successful as we immediately started getting text messages on a variety of issues, including inquiries about obtaining a loan.”

Jason Ford

President/CEO

“Text communication or meeting a member on their most comfortable channel of communication is key to a successful lending relationship. We are completing some loan applications in as little as 10 minutes. Nobody can hold a candle to what Eltropy has.”

Kristen Shambro

AVP of Operations

“Through our video banking team, we run about 2000 to 3000 video calls per month. We are constantly on calls with engaging with our members from where they need to be.”

Chasmine McIntosh

VP of Digital Banking

“As soon as we started using Text with Eltropy, we saw an immediate difference in our response rates. We have such high volumes of collections, and the bottom line is that people are more likely to respond to Text.”

Leticia Amado

VP of Collections

“In one year on the Eltropy platform, Video Banking became our top channel for account and loan originations. Since we require non-branch wires to be verified over Video Banking, our number of incidents of fraudsters impersonating our members has decreased to zero.”

Ron Winter

CTO

“Texting as a method of communication has been very effective not only in the late-stage collection but also reaching some of our members in the earlier stages of collections. We are very satisfied with this process.”

Bert Jones

Collections Manager

“It has actually cut down quite a bit of lag time in between the members waiting for their documents and wondering where they sent it and when it is happening.”

Stephanie Dulaney

Director of Loan Operations

“Email is becoming archaic in lending. To stay relevant today, you have to have text messaging capabilities. Without Eltropy, we would be struggling to meet our members’ expectations for modern communication.”

Tony Sanches

VP of Lending

“Using Eltropy texting for our Collections and Recovery departments, we’re collecting way more than ever before. By sending delinquent payment reminders with secure payment links, we had a record-breaking collections year in 2021, collecting $48.3 million and recovering $9.9 million in principal from charged-off loans, and we continue to see these positive results year after year.”

Lisa Weinstein

VP of Member Relationship Product Management

“Our lead generation for loans is stronger than it’s ever been before. We process 1200 more digital leads per month ever since. In fact, we’ve had to expand and build out two teams to meet the increasing demand.”

Robert Blake

VP of Digital Marketing

“Our members who would never pick up our collection’s calls opened up their hearts on Text. I continue to be blown away with how effective Text Messaging is for loss mitigation.”

Shawn Spratte

SVP of Loss Mitigation and Communication Center

“Some collectors don’t like change. But as soon as they started using it, they realized how helpful Texting can be. It’s an easier way to communicate. And the collectors are happy that they can actually make contact with people.”

Leticia Amado

VP of Collections

“Eltropy has been a great partner in helping us come up with solutions. The entire Eltropy team was vested in making sure we were successful. I think that’s also the benefit of working with smaller firms who are engaged and really believers in their solution and what they’re selling. The moment we sent out the first campaign, we started taking payments right away. It was just amazing. The receptivity from the member base was automatic. It’s not embarrassing… [members] just click here, they execute the transaction, 1-2-3, and it’s done. Our collections manager has been amazed. When you see the numbers out of the gate in the first month, you realize how much of a difference it makes. Eltropy allows us to handle the low-hanging fruit while our team focuses on more complex transactions.”

Anthony Mero

CEO

“We were inundated with loan applications…we weren’t making contact with approved applicants for 30 days. Now were able to get to those applications far more efficiently with Eltropy’s auto reminders.”

Mary Burruel

VP of Project Management

“Having the speed or the ability to have a quick conversation with our members really takes our operations to the next level. Most of us are not waiting around for email. Texts are what people are checking. It was really the next evolution for us as a credit union to move forward with our technology journey.”

Ken Barr

Director of Marketing

“In one year on the Eltropy platform, Video Banking became our top channel for account and loan originations. Since we require non-branch wires to be verified over Video Banking, our number of incidents of fraudsters impersonating our members has decreased to zero.”

Ron Winter

CTO

“Eltropy is a great partnership for Sharetec because it allows our Credit Unions the power to connect with their members and stay competitive in a world where quick service is so important. This platform is easy to use and comes with so many benefits: workflows, automations, compliance and security all in one.”

Carrie Heck

Senior Account Executive

“MeridianLink and Eltropy coming together under one platform is like having your right hand and left hand working at the same speed, on the same page, in the same book. It was our top priority at Natco to make this integration successful and Eltropy made it really simple.”

Kimberley Davis

Branch Manager

“We saw roughly a 20% decrease in calls almost right out of the gate, and by the time we got Ruth into digital banking, it was significant.”

Jill Schaffler

SVP of Enterprise Applications

“The efficiency is just phenomenal. Now it takes 10 seconds to analyze and look at a message rather than getting the call, listening to the voicemail, calling back, and possibly getting another voicemail if they’re sleeping.”

Tiffany Stephens

Talent Acquisition and Employee Relations Manager

“With Eltropy, we’ve discovered just how much our credit union can do. We’ve found services we didn’t even know we had, and we’re training our teams to do new things. It’s really expanding what we can offer our members.”

Joshua Paredes

VP of Member Experience

“With Eltropy, we were able to offer our members convenience and access to be able to do banking when they want to do their banking, not when we want them to do their banking.”

Carmen Sanchez

VP of Virtual Delivery

“After using Eltropy Texting for five years, we’ve been slowly turning on each of the features over the past year. We’ve been doing In-Branch Video for about seven months and started using Eltropy’s Appointment Management and Chat for about nine months now. And we started using bank from anywhere just recently. So far it’s been fantastic.”

Melissa Wrycha

Chief Experience Officer

“We saw a significant drop in routine calls, allowing our associates to focus on deeper, more meaningful conversations with members instead of handling basic self-service inquiries.”

Brandy Roy

VP of Information Technology

“We now have more channels to communicate with our members. Texting has been effective from a collections perspective when reaching out to contact members. We’re also rolling out texting for our lending and branch teams, which will support loan closings and account openings. Members now text us instead of waiting on hold, and we’ve seen an increase in automation and self-serve options.”

Eryka Ragsdale

VP of Member Services

“The beauty of Eltropy is playing nicely and integrating seamlessly with other systems. Not only did we do that, but we also layered in a repayment link so the member could get a reminder and pay directly from their external financial institution account.”

Fred Perez

SVP, Chief Lending Officer

“I work with about almost 20 different vendors across the credit union. Working with Eltropy has been in my top three – the whole time from the implementation to now and the after-hours support. So, if any other CFI is looking into implementing any kind of a texting solution, that’s the vendor.”

Nik Dokic

Business Analyst/Project Manager

“I can’t tell you how many times I had staff come up to me saying, ‘Oh, my God, you made my life so much easier, and now I can multitask and contact various members all throughout the day.’ That was my aha moment – Eltropy’s One Platform is truly paying off for us.”

Sean Manion

VP of Lending

“From a product standpoint, I really believe in Eltropy products and they are effective. They have that ‘it factor’ that many other organizations strive for but haven’t quite been able to put their thumb on it.”

Eryka Ragsdale

VP of Member Services

“We chose Eltropy based on the fact that they were a partner with our core, Sharetec. Just because we wanted to be able to reach our members another way, rather than just over the phone or through Email.”

Colin Poe

Business Development Manager

“Time is one of our most precious resources, and this tool will allow our customers to manage and use their time more effectively. They can now hop on a call and resolve their banking needs in just a few minutes.”

Donna Driscoll

VP Branch Administration

“It really helps just to be there for our members in a different way, just based on the fact that evolution is happening every day. Texting is just becoming more of the language that we use. So just being able to offer that to someone, whether they’re looking for a mortgage, car loan, or just wanting to know what their balance is – we can offer that to them.”

Colin Poe

Business Development Manager

“Bringing in Video Banking has proven immensely successful in not only reducing wait times at our busiest branches but also efficiently addressing staffing needs at our remote locations.”

Jeremy Deamer

Branch Technology & Innovation Manager

“The generative AI solution from Eltropy gives our employees information right at their fingertips. It helps us achieve first call resolution more often because our contact center staff don’t have to chase down info or follow up repeatedly with members.”

Brad Shafton

SVP, IT & Digital

“Everybody knows how to use their cell phone. Having the ability to text someone and offer assistance has been a game changer. We can send them a link to our loan extension request via Text to get the conversation flowing.”

Leticia Amado

VP of Collections

“The Friday text reminder is where we see the most payments. Members often tell us it’s convenient for them to get the reminder right before the weekend.”

Cynthia Moreno

Collections Officer

“I was able to Text this member and get through the application two mornings in a row between 6:30 and 8:00 a.m., and get him approved. He came in at 8:05 that second day and signed the paperwork. That was the moment for our entire credit union—it really was: Yeah, this is worth it.”

Colin Poe

Business Development Manager

“It’s really been a lifeline for our branches, especially during Covid when it was a struggle to keep branches open. Since then we’ve even found that more and more members prefer doing business with us this way!”

Jeremy Deamer

Branch Technology & Innovation Manager

“We scaled our outreach as delinquencies increased, without having to add new staff. That’s been crucial to keeping us efficient.”

Lilly Megias

COO

“We’ve texted thousands of members — maybe two or three have opted out on the lending piece. I love seeing the amount of contacts that are enhanced and improved since we’ve started with Eltropy.”

VP of Lending

VP of Lending

“The product is truly amazing. The ease of connecting with members, sharing screens and documents during conversations, and guiding them through website difficulties with screen sharing has been a game changer. “

Iwona Leatherberry

Digital Banking Manager

“The moment we sent out the first campaign, we started taking payments right away. It was just amazing. The receptivity from the member base was automatic. It’s not embarrassing… [members] just click here, they execute the transaction, 1-2-3, and it’s done.

Our collections manager has been amazed. When you see the numbers out of the gate in the first month, you realize how much of a difference it makes. Eltropy allows us to handle the low-hanging fruit while our team focuses on more complex transactions.”

Anthony Mero

CEO

“I can’t tell you how many times I had staff come up to me saying, ‘Oh, my God, you made my life so much easier, and now I can multitask and contact various members all throughout the day.’ That was my aha moment – Eltropy’s One Platform is truly paying off for us.”

Sean Manion

VP of Lending

“It seemed so simple and intuitive to use! All the steps made sense. We had an easy time envisioning how it would integrate with our other platforms and improve our member service experience.”

Iwona Leatherberry

Digital Banking Manager

“Within three months of implementing Eltropy, we saw a huge drop in delinquencies. When I saw the numbers, I almost couldn’t believe it. It was mind-blowing – We knew we made the right choice.”

Katie Bendyk

Director of eServices & Payment Solutions

“In early ’22, we implemented Eltropy to really enhance communication between members and our staff, especially for collecting documents. Once we saw the pain point – members struggling to hear from us, and us struggling to hear from them – switching to Eltropy made all of that go away.”

Sean Manion

VP of Lending

“From day one, Eltropy’s leadership team actively listened to our specific requests, demonstrating their remarkable receptiveness and adaptability. They seamlessly accommodated all our needs, allowing us to test functionalities in a demo environment and promptly addressing our questions.”

Iwona Leatherberry

Digital Banking Manager

“The way MeridianLink and Eltropy work together has been remarkable. We’re seeing loan officers close deals faster because they can text right from within the loan file. When a member needs to submit additional documentation or sign something, our team can send a quick text and often get a response within minutes rather than days. The efficiency gains have been incredible.”

Tony Sanches

VP of Lending

“We had a one-way Texting, which didn’t allow for member responses. We also had an old-school email portal system where members had to log in with verification details just to see our messages. It was secure but definitely not efficient. Eltropy changed that.”

Nicholas Cole

Senior Lending Systems Administrator

“Video Banking has taken digital services to the next level. What we do with Eltropy’s video solution is offer a full branch experience to our members.”

Sarah Kuesel

Senior Manager

“The automated alerts have fundamentally changed how we communicate. Members can actually start a conversation from that initial alert message. Without us doing anything manually at SAFE, the system gets them the message, they reply back, and we can immediately engage with them.”

Nicholas Cole

Senior Lending Systems Administrator

“It was like walking up to a window, but I didnʼt leave my home! Perfect to allow me to keep banking with Clearview since I moved out of the state.”

Lynn

Clearview Live® User

“The Eltropy platform itself has really helped us have that next level of communication with our members. Having the speed and the ability to have a quick conversation with our members takes our operations to the next level.”

Ken Barr

Director of Marketing

“We’re actively preparing for the new regulations, and we’ll be working with compliance and marketing to update our templates accordingly. The credit freeze template’s success has shown us the potential for new automated solutions, and we’re looking forward to rolling out more templates across additional departments.”

Nicholas Cole

Senior Lending Systems Administrator

“We all know wire fraud has been on the rise. The video banking platform allows us to visually identify all of our customers who want to perform a wire transfer, thus basically eliminating the chance of wire fraud.”

Maria Nephew

AVP of Virtual Banking Manager

“On a scale of 1-10, the competitors we saw might’ve been a 5, and Eltropy was a 10+. For us, it was so easy to use, we just turned it on and were off and running”.

Pete VanGraafeiland

Chief Member Experience Officer

“We chose Eltropy because they could provide more than just the ability to message members. This partnership allows us to connect with members across multiple interactions. When looking for a new LOS, the need for greater communication through the application process was a necessity.”

Tyler McCurdy

Lending Program Manager

“If a customer lives out of the area or says that they have trouble getting into the branch, it’s no problem. We refer them in a minute to the video channel, where we can assist customers from all segments, be it a deposit, something loan-related, or whatever they need. Customers can get personalized service from their trusted banker, and they can do it from anywhere, even in the UK or Europe.”

Donna Driscoll

VP Branch Administration

“The very first thing we do once a loan is approved is send them a congratulations text. We also send over an email, but what we’ve found is overwhelmingly, people respond back via text.”

Pete VanGraafeiland

Chief Member Experience Officer

“The Eltropy – Sync1 Systems integrations is so seamless that most of our lenders see it as part of their normal workflow. It’s fully embedded inside our LOS; a text box pops up, allowing them to communicate directly with members who have consented. They don’t have to think about switching between systems.”

Tyler McCurdy

Lending Program Manager

“You can tell Eltropy cares about us, and they really are all about listening to us. When there’s something in the system that maybe doesn’t fit our needs, they’ll try to understand the why behind it and actually do something about it.”

Melissa Wrycha

Chief Experience Officer

“Being able to use the system in the same way across departments—whether it’s lending, collections, or the contact center—has been a game changer. Everybody absolutely loves the system. It’s very intuitive and easy to use.”

Nik Dokic

Business Analyst/Project Manager

“We can now complete the entire process from application creation to underwriting submission, all in a single phone call. Before, it was ‘Hey, I’ll call you back when I gather it’ or follow-up calls. Now we can have a conversation, and as I’m asking for things, I can text it over.”

Tyler McCurdy

Lending Program Manager

“If you can dream it, Eltropy can probably make it. The amazing thing with the Eltropy team is there has not been one thing that we’ve thought up or had an idea of where they have said, “No, we can’t do it”. It’s always been, “oh, we’ve already thought of that” 90% of the time, and the 10% that it hasn’t been, “it’s that’s a great idea. We’ll start talking about that internally and see when we can push that into production and make it tangible.”

Eryka Ragsdale

VP of Member Services

“By itself, Eltropy is great, but we had to push the campaigns manually. With Eltropy+Akuvo integration, it changed the game considerably because now we could set the campaigns to occur at certain intervals. It took the manual process out of the equation, and the campaigns would run automatically.”

Fred Perez

SVP, Chief Lending Officer

“Voice+ will make a big difference in how we serve our members. Our agents can now use voice alongside text, video, co-browsing, and AI help. This means we can solve problems faster and better, all in one place. It’s a real improvement for our members.”

Howie Meller

President and CEO

“What Eltropy is doing with its Unified Conversations Platform will only magnify and highlight all the other technology enhancements that we’re currently making for our members across all departments of the organization. In the end, we’re improving our financial and communications technology to help our employees first, so they can in turn help our members have a better banking experience.”

Carter Pope

CEO

“We saw roughly a 20% decrease in calls almost right out of the gate, and by the time we got Ruth into digital banking, it was significant.”

Jill Schaffler

SVP of Enterprise Applications

“We saw a significant drop in routine calls, allowing our associates to focus on deeper, more meaningful conversations with members instead of handling basic self-service inquiries.”

Brandy Roy

VP of Information Technology

“Being on the Eltropy platform makes my heart happy. We sleep well at night knowing our agents are using secure text.”

Jeff Sanders

VP of IT

“People who never responded before are responding now. It’s like we’ve suddenly started speaking their language, and they’re actually listening. It’s amazing. In my 20 years in the credit union industry, this is the most game-changing innovation I’ve seen.”

Art Sookazian

VP of Special Services

“The adoption by the members has been quick and successful as we immediately started getting text messages on a variety of issues, including inquiries about obtaining a loan.”

Jason Ford

President/CEO

“Text communication or meeting a member on their most comfortable channel of communication is key to a successful lending relationship. We are completing some loan applications in as little as 10 minutes. Nobody can hold a candle to what Eltropy has.”

Kristen Shambro

AVP of Operations

“As soon as we started using Text with Eltropy, we saw an immediate difference in our response rates. We have such high volumes of collections, and the bottom line is that people are more likely to respond to Text.”

Leticia Amado

VP of Collections

“Texting as a method of communication has been very effective not only in the late-stage collection but also reaching some of our members in the earlier stages of collections. We are very satisfied with this process.”

Bert Jones

Collections Manager

“It has actually cut down quite a bit of lag time in between the members waiting for their documents and wondering where they sent it and when it is happening.”

Stephanie Dulaney

Director of Loan Operations

“Email is becoming archaic in lending. To stay relevant today, you have to have text messaging capabilities. Without Eltropy, we would be struggling to meet our members’ expectations for modern communication.”

Tony Sanches

VP of Lending

“Using Eltropy texting for our Collections and Recovery departments, we’re collecting way more than ever before. By sending delinquent payment reminders with secure payment links, we had a record-breaking collections year in 2021, collecting $48.3 million and recovering $9.9 million in principal from charged-off loans, and we continue to see these positive results year after year.”

Lisa Weinstein

VP of Member Relationship Product Management

“Our lead generation for loans is stronger than it’s ever been before. We process 1200 more digital leads per month ever since. In fact, we’ve had to expand and build out two teams to meet the increasing demand.”

Robert Blake

VP of Digital Marketing

“Our members who would never pick up our collection’s calls opened up their hearts on Text. I continue to be blown away with how effective Text Messaging is for loss mitigation.”

Shawn Spratte

SVP of Loss Mitigation and Communication Center

“Some collectors don’t like change. But as soon as they started using it, they realized how helpful Texting can be. It’s an easier way to communicate. And the collectors are happy that they can actually make contact with people.”

Leticia Amado

VP of Collections

“Eltropy has been a great partner in helping us come up with solutions. The entire Eltropy team was vested in making sure we were successful. I think that’s also the benefit of working with smaller firms who are engaged and really believers in their solution and what they’re selling. The moment we sent out the first campaign, we started taking payments right away. It was just amazing. The receptivity from the member base was automatic. It’s not embarrassing… [members] just click here, they execute the transaction, 1-2-3, and it’s done. Our collections manager has been amazed. When you see the numbers out of the gate in the first month, you realize how much of a difference it makes. Eltropy allows us to handle the low-hanging fruit while our team focuses on more complex transactions.”

Anthony Mero

CEO

“We were inundated with loan applications…we weren’t making contact with approved applicants for 30 days. Now were able to get to those applications far more efficiently with Eltropy’s auto reminders.”

Mary Burruel

VP of Project Management

“Having the speed or the ability to have a quick conversation with our members really takes our operations to the next level. Most of us are not waiting around for email. Texts are what people are checking. It was really the next evolution for us as a credit union to move forward with our technology journey.”

Ken Barr

Director of Marketing

“Eltropy is a great partnership for Sharetec because it allows our Credit Unions the power to connect with their members and stay competitive in a world where quick service is so important. This platform is easy to use and comes with so many benefits: workflows, automations, compliance and security all in one.”

Carrie Heck

Senior Account Executive

“MeridianLink and Eltropy coming together under one platform is like having your right hand and left hand working at the same speed, on the same page, in the same book. It was our top priority at Natco to make this integration successful and Eltropy made it really simple.”

Kimberley Davis

Branch Manager

“The efficiency is just phenomenal. Now it takes 10 seconds to analyze and look at a message rather than getting the call, listening to the voicemail, calling back, and possibly getting another voicemail if they’re sleeping.”

Tiffany Stephens

Talent Acquisition and Employee Relations Manager

“With Eltropy, we’ve discovered just how much our credit union can do. We’ve found services we didn’t even know we had, and we’re training our teams to do new things. It’s really expanding what we can offer our members.”

Joshua Paredes

VP of Member Experience

“After using Eltropy Texting for five years, we’ve been slowly turning on each of the features over the past year. We’ve been doing In-Branch Video for about seven months and started using Eltropy’s Appointment Management and Chat for about nine months now. And we started using bank from anywhere just recently. So far it’s been fantastic.”

Melissa Wrycha

Chief Experience Officer

“We now have more channels to communicate with our members. Texting has been effective from a collections perspective when reaching out to contact members. We’re also rolling out texting for our lending and branch teams, which will support loan closings and account openings. Members now text us instead of waiting on hold, and we’ve seen an increase in automation and self-serve options.”

Eryka Ragsdale

VP of Member Services

“The beauty of Eltropy is playing nicely and integrating seamlessly with other systems. Not only did we do that, but we also layered in a repayment link so the member could get a reminder and pay directly from their external financial institution account.”

Fred Perez

SVP, Chief Lending Officer

“I work with about almost 20 different vendors across the credit union. Working with Eltropy has been in my top three – the whole time from the implementation to now and the after-hours support. So, if any other CFI is looking into implementing any kind of a texting solution, that’s the vendor.”

Nik Dokic

Business Analyst/Project Manager

“I can’t tell you how many times I had staff come up to me saying, ‘Oh, my God, you made my life so much easier, and now I can multitask and contact various members all throughout the day.’ That was my aha moment – Eltropy’s One Platform is truly paying off for us.”

Sean Manion

VP of Lending

“We chose Eltropy based on the fact that they were a partner with our core, Sharetec. Just because we wanted to be able to reach our members another way, rather than just over the phone or through Email.”

Colin Poe

Business Development Manager

“It really helps just to be there for our members in a different way, just based on the fact that evolution is happening every day. Texting is just becoming more of the language that we use. So just being able to offer that to someone, whether they’re looking for a mortgage, car loan, or just wanting to know what their balance is – we can offer that to them.”

Colin Poe

Business Development Manager

“Everybody knows how to use their cell phone. Having the ability to text someone and offer assistance has been a game changer. We can send them a link to our loan extension request via Text to get the conversation flowing.”

Leticia Amado

VP of Collections

“The Friday text reminder is where we see the most payments. Members often tell us it’s convenient for them to get the reminder right before the weekend.”

Cynthia Moreno

Collections Officer

“I was able to Text this member and get through the application two mornings in a row between 6:30 and 8:00 a.m., and get him approved. He came in at 8:05 that second day and signed the paperwork. That was the moment for our entire credit union—it really was: Yeah, this is worth it.”

Colin Poe

Business Development Manager

“We scaled our outreach as delinquencies increased, without having to add new staff. That’s been crucial to keeping us efficient.”

Lilly Megias

COO

“We’ve texted thousands of members — maybe two or three have opted out on the lending piece. I love seeing the amount of contacts that are enhanced and improved since we’ve started with Eltropy.”

VP of Lending

VP of Lending

“The moment we sent out the first campaign, we started taking payments right away. It was just amazing. The receptivity from the member base was automatic. It’s not embarrassing… [members] just click here, they execute the transaction, 1-2-3, and it’s done.

Our collections manager has been amazed. When you see the numbers out of the gate in the first month, you realize how much of a difference it makes. Eltropy allows us to handle the low-hanging fruit while our team focuses on more complex transactions.”

Anthony Mero

CEO

“I can’t tell you how many times I had staff come up to me saying, ‘Oh, my God, you made my life so much easier, and now I can multitask and contact various members all throughout the day.’ That was my aha moment – Eltropy’s One Platform is truly paying off for us.”

Sean Manion

VP of Lending

“Within three months of implementing Eltropy, we saw a huge drop in delinquencies. When I saw the numbers, I almost couldn’t believe it. It was mind-blowing – We knew we made the right choice.”

Katie Bendyk

Director of eServices & Payment Solutions

“In early ’22, we implemented Eltropy to really enhance communication between members and our staff, especially for collecting documents. Once we saw the pain point – members struggling to hear from us, and us struggling to hear from them – switching to Eltropy made all of that go away.”

Sean Manion

VP of Lending

“The way MeridianLink and Eltropy work together has been remarkable. We’re seeing loan officers close deals faster because they can text right from within the loan file. When a member needs to submit additional documentation or sign something, our team can send a quick text and often get a response within minutes rather than days. The efficiency gains have been incredible.”

Tony Sanches

VP of Lending

“We had a one-way Texting, which didn’t allow for member responses. We also had an old-school email portal system where members had to log in with verification details just to see our messages. It was secure but definitely not efficient. Eltropy changed that.”

Nicholas Cole

Senior Lending Systems Administrator

“The automated alerts have fundamentally changed how we communicate. Members can actually start a conversation from that initial alert message. Without us doing anything manually at SAFE, the system gets them the message, they reply back, and we can immediately engage with them.”

Nicholas Cole

Senior Lending Systems Administrator

“The Eltropy platform itself has really helped us have that next level of communication with our members. Having the speed and the ability to have a quick conversation with our members takes our operations to the next level.”

Ken Barr

Director of Marketing

“We’re actively preparing for the new regulations, and we’ll be working with compliance and marketing to update our templates accordingly. The credit freeze template’s success has shown us the potential for new automated solutions, and we’re looking forward to rolling out more templates across additional departments.”

Nicholas Cole

Senior Lending Systems Administrator

“On a scale of 1-10, the competitors we saw might’ve been a 5, and Eltropy was a 10+. For us, it was so easy to use, we just turned it on and were off and running”.

Pete VanGraafeiland

Chief Member Experience Officer

“We chose Eltropy because they could provide more than just the ability to message members. This partnership allows us to connect with members across multiple interactions. When looking for a new LOS, the need for greater communication through the application process was a necessity.”

Tyler McCurdy

Lending Program Manager

“The very first thing we do once a loan is approved is send them a congratulations text. We also send over an email, but what we’ve found is overwhelmingly, people respond back via text.”

Pete VanGraafeiland

Chief Member Experience Officer

“The Eltropy – Sync1 Systems integrations is so seamless that most of our lenders see it as part of their normal workflow. It’s fully embedded inside our LOS; a text box pops up, allowing them to communicate directly with members who have consented. They don’t have to think about switching between systems.”

Tyler McCurdy

Lending Program Manager

“Being able to use the system in the same way across departments—whether it’s lending, collections, or the contact center—has been a game changer. Everybody absolutely loves the system. It’s very intuitive and easy to use.”

Nik Dokic

Business Analyst/Project Manager

“We can now complete the entire process from application creation to underwriting submission, all in a single phone call. Before, it was ‘Hey, I’ll call you back when I gather it’ or follow-up calls. Now we can have a conversation, and as I’m asking for things, I can text it over.”

Tyler McCurdy

Lending Program Manager

“If you can dream it, Eltropy can probably make it. The amazing thing with the Eltropy team is there has not been one thing that we’ve thought up or had an idea of where they have said, “No, we can’t do it”. It’s always been, “oh, we’ve already thought of that” 90% of the time, and the 10% that it hasn’t been, “it’s that’s a great idea. We’ll start talking about that internally and see when we can push that into production and make it tangible.”

Eryka Ragsdale

VP of Member Services

“By itself, Eltropy is great, but we had to push the campaigns manually. With Eltropy+Akuvo integration, it changed the game considerably because now we could set the campaigns to occur at certain intervals. It took the manual process out of the equation, and the campaigns would run automatically.”

Fred Perez

SVP, Chief Lending Officer

“Through our video banking team, we run about 2000 to 3000 video calls per month. We are constantly on calls with engaging with our members from where they need to be.”

Chasmine McIntosh

VP of Digital Banking

“In one year on the Eltropy platform, Video Banking became our top channel for account and loan originations. Since we require non-branch wires to be verified over Video Banking, our number of incidents of fraudsters impersonating our members has decreased to zero.”

Ron Winter

CTO

“With Eltropy, we’ve discovered just how much our credit union can do. We’ve found services we didn’t even know we had, and we’re training our teams to do new things. It’s really expanding what we can offer our members.”

Joshua Paredes

VP of Member Experience

“With Eltropy, we were able to offer our members convenience and access to be able to do banking when they want to do their banking, not when we want them to do their banking.”

Carmen Sanchez

VP of Virtual Delivery

“After using Eltropy Texting for five years, we’ve been slowly turning on each of the features over the past year. We’ve been doing In-Branch Video for about seven months and started using Eltropy’s Appointment Management and Chat for about nine months now. And we started using bank from anywhere just recently. So far it’s been fantastic.”

Melissa Wrycha

Chief Experience Officer