Enhancing Member Engagement with Two-Way Text Messaging

Two Way Text Messaging is a great way to keep in touch with your members. It’s also a cost effective way to reach out to them. Read on to learn more!

There are several reasons why you should use two way texting as part of your business strategy.

- First, it helps build relationships with your members.

- Second, it gives you an opportunity to provide helpful information to your members.

- Third, it provides a low cost alternative to other forms of communication such as email and phone calls.

- Fourth, it lets you stay connected with your members even when they aren’t online.

- Fifth, it makes it easy for you to communicate with your members at any time.

- Sixth, it saves money by reducing the number of times you need to contact your members.

- Seventh, it keeps your member base engaged and interested in what you have to offer.

- Eighth, it allows you to interact with your members in real time.

- Ninth, it allows you to track how often people respond to your messages.

- Tenth, it allows you to measure the effectiveness of your communications.

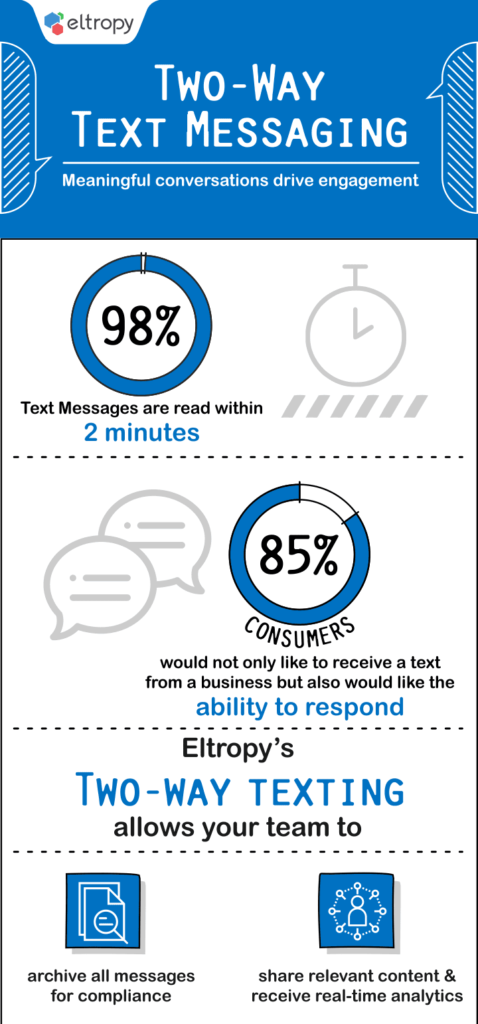

With Eltropy’s Two-way Text Messaging Credit Unions and Community Banks now have the power to not only Send & Receive but also to Track, Measure and Improve their Conversations effectively.