This article originally appeared on creditunions.com and the link to the full article is below.

Credit Unions are always on the lookout for better ways to communicate with members.

Text Messaging has shown itself to be one of the most effective ways of communicating with Credit Union members, especially since it gives members the ability to text back whenever they want. In recent studies, it is shown that within the first 3 minutes of receiving a text message, 98% of all text messages are read. This is a much higher rate than email, which has an average open rate of around 20%.

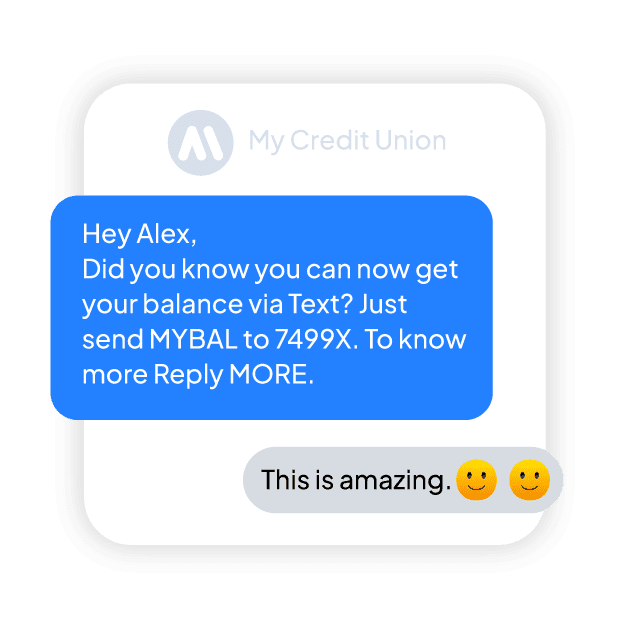

Not only does text messaging increase engagement and retention, but members love it too because it is delivered with a personal touch. Plus, there are plenty of ways to use text messaging to improve the member experience.

For example, you can use text messaging for credit unions to:

- Send reminders for their upcoming payments.

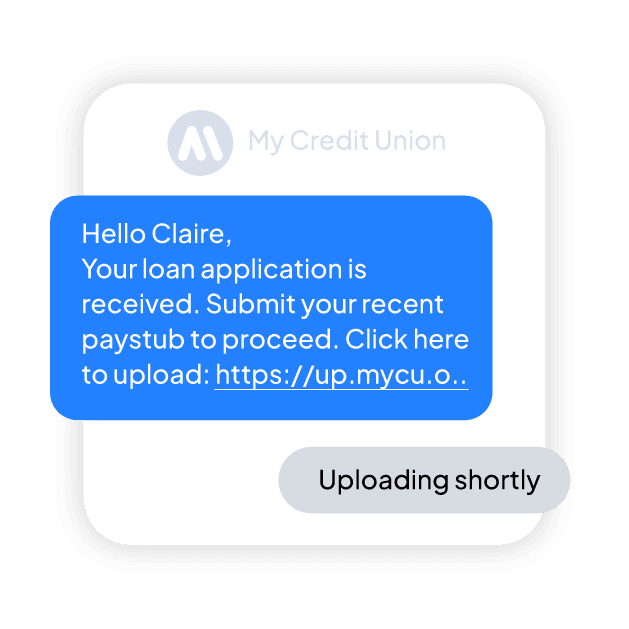

- Speed up lending by using secure links for document collections via text message and enhance member experience.

- Share tips on how members can make the most of their credit union benefits

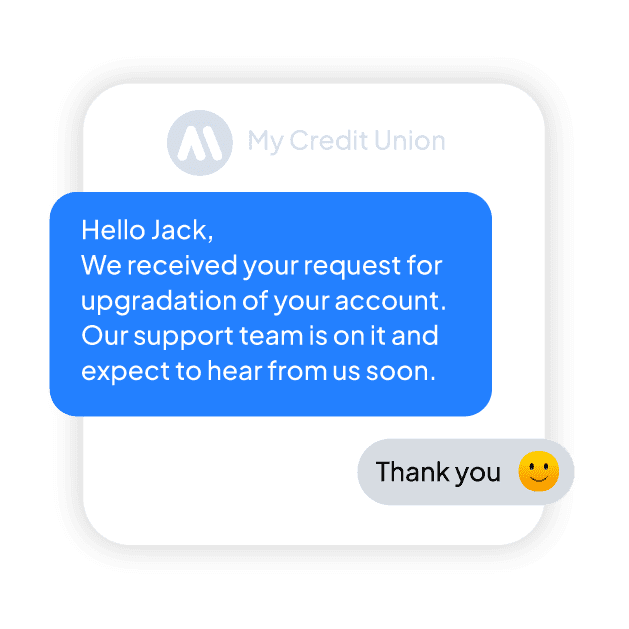

- Provide customer service support

- Notify/Alert members of changes or updates to your credit union’s services

Here, Central Willamette Credit Union, Generations Credit Union, Interra Credit Union, and Georgetown Kraft Credit Union share the ways they use text messaging today, the strategies supporting their future plans, and the advice they have for other cooperatives considering a push to text.

Just In Time

Central Willamette Credit Union($358.2M, Albany, OR) launched its text messaging initiative on March 25, 2020 — just two days after the state’s “stay home, stay healthy” order to combat the spread of COVID-19 took effect.

“We instituted emergency messaging as our first big push,” says Stacie Wyss-Schoenborn, president and chief executive officer.

President/CEO, Central Willamette Credit Union

The credit union now uses text messages to communicate one-on-one with members through branch- specific lines, but the initial emergency message directed all members to a COVID landing page that presented detailed information and instructions regarding how to contact the credit union by phone, email, and secure message.

Marketing Manager, Central Willamette Credit Union

The deliverability of that first emergency message was high. Approximately 75% of members received the text at the mobile number they had on file with the credit union; approximately 14% opened and read it. But something beyond numbers piqued the interest of the credit union.

“After we sent the initial text, we found members referred back to that text message for the link to our landing page without us sending subsequent messages,” says Erik Fedler, marketing manager at Central Willamette.

“Members knew how to get to the information and simply went back to the page, which we kept updating.”

To read the full article go here.

About Us: Eltropy is the first Text Messaging solution for Credit Unions that offers both secure, verified two-way texting and compliance with Federal regulations.

Built specifically for credit unions, Eltropy’s texting/digital communications platform is used by over 300+ credit unions nationwide. Eltropy is voted best texting solution for credit unions by CUNA Strategic Services and is endorsed by the Michigan Credit Union League.

Learn more about us www.eltropy.com