You can take advantage of these new capabilities to optimize your collections strategy.

You can gain deeper insight into customer psychology, which helps you create tailored payment plans that meet customers’ needs. This automated and customized payment strategy is critical for improving repayment rates, collections, and loss mitigation.

With omnichannel capabilities, lenders can reach out to customers at any point in the collection process with the most appropriate method: text messages during early stages, voice calls for overdue balances, and emails when customers are close to defaulting. The ability to communicate at multiple touchpoints increases customers’ likelihood of paying their loans on time.

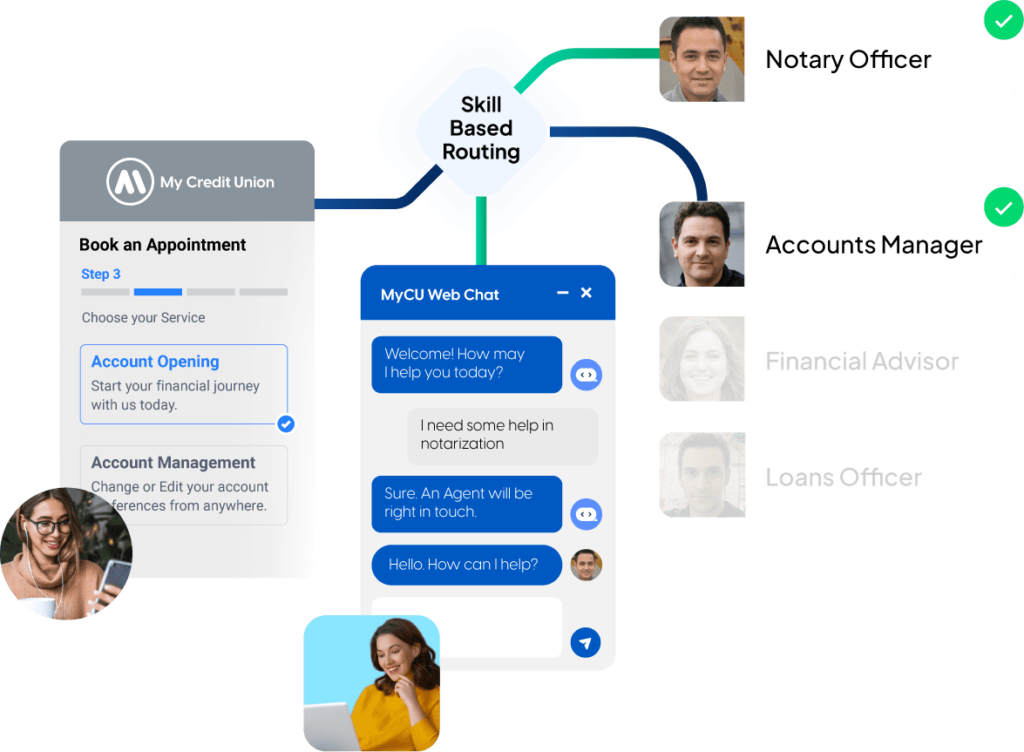

Tools like automated call routing also enable lenders to route calls to the right agent or rep more quickly and efficiently. This saves time and increases productivity, and allows lenders to save money as agents aren’t wasting time waiting for calls.