Eltropy Payments

Turn Every Payment Into a Positive Experience

Eltropy Payments brings together self-serve portals, digital wallets, agent-assisted options, and real-time analytics into one powerful platform, making it simple for consumers to pay their way while helping your team reduce costs, recover more, and build lasting trust.

Measurable impact

Trust the ROI

Eltropy transforms payments into a proactive, modern, and non-intrusive process via a unified conversation platform for credit unions and community banks.

Do More With Less

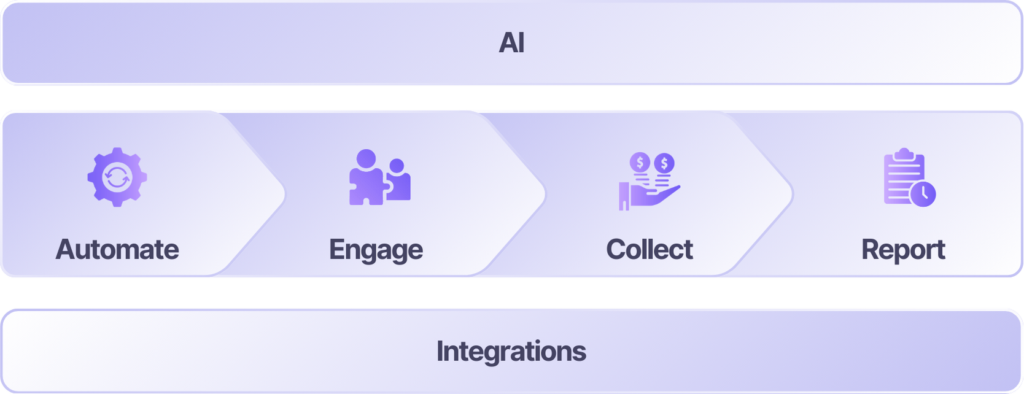

Eltropy Payments

Empower your teams with targeted outreach, self-serve flexible payment options, and AI-powered support,

analytics, and more that refine your payment strategy for better outcomes.

Engage

‘Pay Now’ Links

Sequences of texts and emails released automatically prompt payment with embedded payment links.

Collect

Flexible & Secure Payments

Enable consumers to pay via their preferred method and offer flexible options – full, partial, or installment plans.

Express Pay

Self-Cure & Self-Service Payment

Let consumers securely verify details and self-initiate payments directly from any public-facing website.

Analyze

Real-Time Dashboards

Make better decisions leveraging detailed insights into payment activity & consumer engagement.

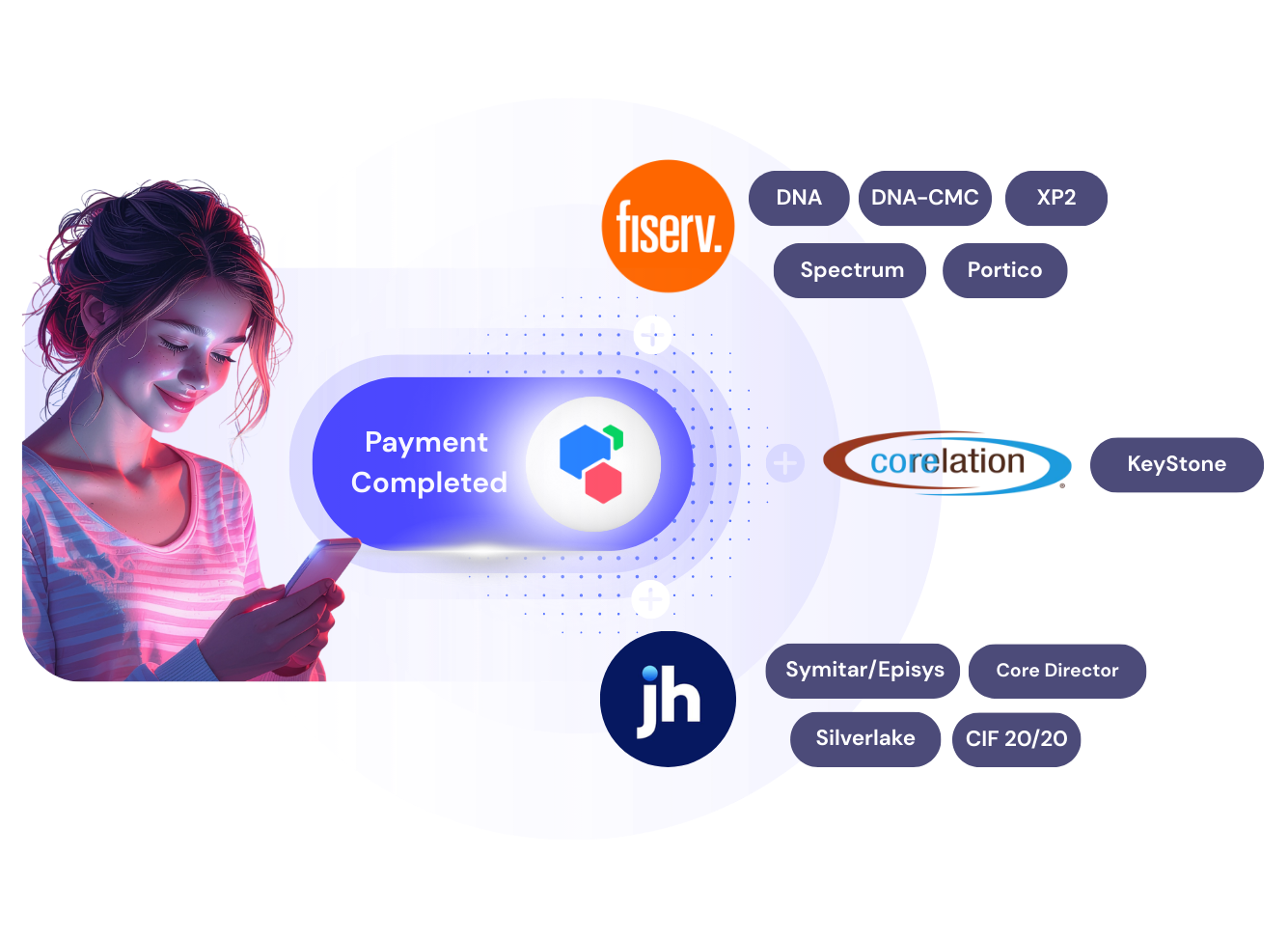

Ecosystem

Out-of-the-Box Integrations

Deliver better outcomes with minimal disruption, supported by 10+ powerful core integrations.

A Better Way To Pay!

‘Pay Now’ Links

Make every payment effortless with embedded ‘Pay Now’ links, delivered through smart text and email reminders that get consumers to pay faster and smarter.

Automate Payment Journey

- Free your team from manual follow-ups by sending automated sequences of text and email reminders with embedded payment links that allow consumers to pay anytime, anywhere.

Strategic Channel Mix to Boost Payments

- Reach the right consumers at the right time with the perfect mix of texts and emails, driving more on-time and early-stage repayments.

Boost Payment Velocity

- Direct payment links make it easy for consumers to pay in just a few clicks and enable teams to recover more dues quickly, even with a leaner people-reach footprint.

Flexible and Secure Payments

Give consumers the freedom to pay through digital wallets, ACH, and more, while offering flexible payment plans – full, partial, or installments.

Boost Payment Completions

- Enable consumers to complete their payments instantly by offering support for multiple methods, including digital wallets (Apple/Google Pay), over-the-phone payments, ACH, and more.

Payment Flexibility

- Empower consumers facing financial difficulties to pay on their own terms with their preferred payment options, such as full, partial, and installment plans.

Remove Payment Friction

- Embed secure payment links directly in Text and Email, which borrowers can use to pay instantly from the browser using their preferred method, without any unnecessary logins or redirects!

Agent-Assisted Payments

- Enable collectors, contact center teams, and account services staff to guide consumers through transactions in real-time via live calls and boost payment completions.

Real Stories, Real Success

“Within three months of implementing Eltropy, we saw a huge drop in delinquencies. When I saw the numbers, I almost couldn’t believe it. It was mind-blowing – We knew we made the right choice.”

Katie Bendyk

Director of eServices & Payment Solutions

“The moment we sent out the first campaign, we started taking payments right away. It was just amazing. The receptivity from the member base was automatic. It’s not embarrassing; members just click, execute the transaction, 1-2-3, and it’s done. Our collections manager has been amazed. When you see the numbers out of the gate in the first month, you realize how much of a difference it makes. Eltropy allows us to handle the low-hanging fruit while our team focuses on more complex transactions.”

Anthony Mero

CEO

“Most members don’t answer calls, so we needed a more effective way to reach them. The fact that our members can make payments at any time with just a link has made a huge difference in our ability to collect on time. Eltropy has allowed us to scale our outreach as delinquencies have increased. That’s been crucial to keeping us efficient.”

Lilly Megias

COO

Self-Cure & Self-Service Payment Portal

Easily embed a payment button on any public-facing website and give consumers access to a branded self-service portal where they can securely verify details and resolve balances instantly.

Pay Anytime, Anywhere

- By embedding the payment portal directly on your website, consumers can settle their dues on their own terms instantly, even outside business hours.

Branded Payment Portal

- Offer a fully branded payment portal with customized brand colors, logos, and more, that align with your brand identity to keep consumers engaged and offer reassurance that they’re paying the right institution.

Reduced Payment Queries

- Enable consumers to self-initiate payments and reduce payment-related interactions, freeing staff to focus on high-value interactions that need their attention.

Use AI to Resolve Issues

- Resolve payment issues instantly via AI Agents or let borrowers schedule an appointment at their convenience - directly within the website/app.

Reporting and Analytics

Data-driven insights on campaigns, consumer behaviour, payment activity, and more, in a granular dashboard or reports that helps provide full visibility into borrower and agent interactions to improve future outcomes.

Improve Payment Efficacy & Efficiency

- Leverage strategic insights into payment activity, engagement, trends, and more to optimize future repayment and campaign outcomes.

Refine Payment Strategy

- Streamline your efforts with performance analytics on messaging templates, trend identification, and refining tactics for faster recoveries.

Simplify Regulatory Compliance

- Leverage embedded audit trails and proof reports to ensure transparency, accountability, and improved compliance.

Built to Deliver ROI

From Reminders to Real Revenue

Eltropy Payments goes beyond one‑way reminders and turns every interaction into an opportunity to drive real impact at scale.

44%

YoY increase in dollar collected

72%

More payment texts sent

38%

YoY increase in people reached

10+ Core Integrations

Supported By An Integrated Ecosystem

Eltropy Payments seamlessly integrates with your core systems, including Jack Henry, Fiserv, Corelation, and more, to drive better payment outcomes with minimal disruption.

Artificial Intelligence

Powered By Eltropy Safe AI

Eltropy Collections 2.0 is powered by Safe AI which delivers sharp collection insights, smart automation, personalized engagement, and AI-driven assistance for maximum efficiency and results.

AI Contact Preference

“Show them you know them”

Securely analyze member and customer engagement to identify the best time, channel, and language for communication, keeping collections officers informed and enhancing personalized interactions.

Automated Intelligent Reminders

Sends personalized automatic text reminders, optimizing message timing based on member/customer preferences.

#Enhanced Engagement #Increased click-through rates for higher efficiency

Collection Insights

“Data Rules!!”

Deep insights into collections campaigns.

Comprehensive dashboards with campaign performance analysis that allow collections teams to make data-driven decisions for improved outcomes.

Advanced Collection Intelligence

Rich insights into delinquent members and customers inclusive of underlying reasons.

Enables collectors to approach members and customer with empathy, making each interaction more effective & compassionate.

Assure Quality with AI Scoring

The system automatically scores each call by meticulously analyzing it – to identify reasons for delinquency and ensure adherence to quality standards.

AI Assistant for Collectors

Provides collectors with instant access to policies and procedures [Powered by advanced language models]

#Reduced Average Handle Time (AHT) #Increased First Contact Resolution (FCR) #Improved overall efficiency

Get Started

Get The Winning Workflow

Empower your collections team with empathetic outreach, self-serve flexible payments, automated AI workflows,

and analytics that refine your collections strategy for better collection outcomes.