Loan Repayment & Collections Solution That Works for You and Your Community.

Unlock a better way to collect with Eltropy Collections 2.0 – A people-first debt repayment and collections stack that empowers credit unions and community banks to collect more with less friction.

Measurable impact

Trust the ROI

Eltropy transforms debt repayment and collections into a proactive, non-intrusive, and empathetic process via a unified conversations platform for credit unions and community banks.

Do More With Less

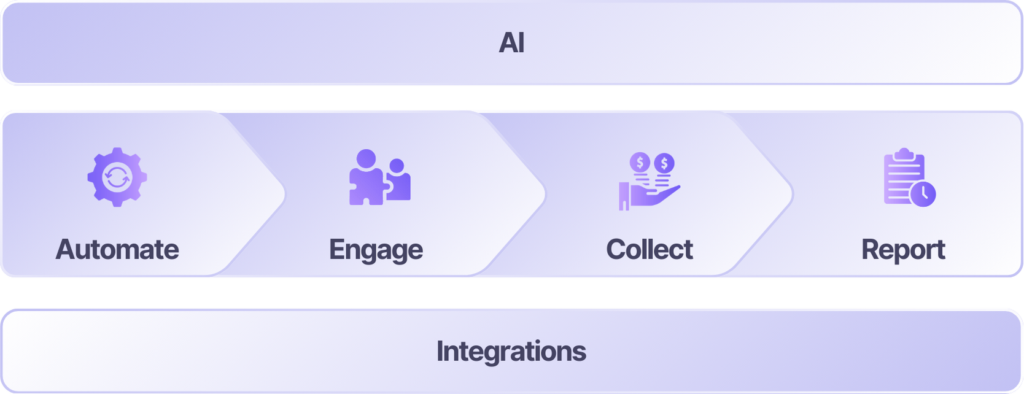

Eltropy Collections 2.0 Suite

Empower your collections team with empathetic outreach, self-serve flexible payments, automated AI workflows,

and analytics that refine your collections strategy for better collection outcomes.

Automate

Smart Workflows & Outreach

Strategic collections outreach delivered via text and email sequences at the right day & time.

Engage

Borrower-Focused Messaging

Make borrowers feel supported with empathetic, personalized, and people-first communication.

Collect

Flexible, Secure & Self-Serve

Collect using fast, secure, and easy payment options via a custom-branded payment portal.

Report

Real-Time Dashboards

Make better decisions leveraging detailed insights into borrower activity & engagement.

Eltropy AI

Safe, Powerful & CFI-Focused

Do more with less – AI-powered automation, engagement, insights, and assistance.

Ecosystem

Out-of-the-box Integrations

Deliver better outcomes with minimal disruption, supported by 35+ powerful integrations.

Collection 2.0

A Better Way To Collect!

Automate

Strategic sequence of Texts & Emails (reminders, follow-ups, or alerts) triggered by pre-defined rules and actions – designed to maximize payment rates & enhance the overall experience for your members and customers.

Maintain Consistent & Balanced Outreach

- Deliver consistent and balanced collections communication over emails and texts to make member/customer feel valued and supported during the challenging times in a non-intrusive yet empathetic manner.

Improve Response Rates & Engagement

- Automate the campaign deployment schedule for the best time and day - based on AI and ML insights (past member/customer behaviour, trends, and more). Meet members and customers where they are, at their schedules.

Engage

Empathetic, non-intrusive, personalized, and people-first collection communications outreach, that feels like a natural extension of your brand experience – enhances engagement and builds trust.

Ensure People-First Collections Experience

- Provide borrowers a non-intrusive, convenient, fast, and secure way to connect with agents in real-time over 1:1 Text or Email. If needed agent can switch from a Text session to a Voice call with just one-click using Text to Talk (A no-dial option that reduces call charges).

Personalize Engagement at Scale

- Use multi-language, pre-defined, and highly customizable Text and Email templates [1:1 and 1: Many - Text & Email Templates] to personalize every communication and maintain consistency across the organization. Also branded with your brand colors and logos.

Real Stories, Real Success

“Within three months of implementing Eltropy, we saw a huge drop in delinquencies. When I saw the numbers, I almost couldn’t believe it. It was mind-blowing – We knew we made the right choice.“

Katie Bendyk

Director of eServices & Payment Solutions

“The moment we sent out the first campaign, we started taking payments right away. It was just amazing. The receptivity from the member base was automatic. It’s not embarrassing, members just click here, they execute the transaction, and it’s done.”

Anthony Mero

Chief Executive Officer

“With Eltropy texting, we’re collecting way more than ever before in our history – collecting $48.3 million and recovering $9.9 million in principal from charged-off loans, and we continue to see these positive results year after year.”

Lisa Weinstein

VP of Member Relations

“Some collectors don’t like change. But as soon as they started using it, they realized how helpful Texting can be. It’s an easier way to communicate. And the collectors are happy that they can actually make contact with people.”

Leticia Amado

Collections Manager

“Our members who would never pick up our collection’s calls opened up their hearts on Text. I continue to be blown away with how effective Text Messaging is for loss mitigation.”

Shawn Spratte

VP of Collections

Collect

Branded payment portals that guide borrowers using a clear, focused process to resolve their due balances with ease. Let borrowers pay anytime, anywhere with self-serve & flexible payment options.

Remove Payment Friction

- Provide easy, secure, and convenient payment methods to maximize payment rates. Embed secure payment links directly in Text and Email which borrowers can use to pay instantly from the browser – no unnecessary logins or redirects!

Provide Payment Flexibility

- Empower members and customers facing financial difficulties to pay on their own terms with empathetic payment options such as full and partial instalment plans, and flexible payment options.

Resolve Payment Issues - Fast!

- Resolve payment issues instantly via AI-powered Agents or let borrowers schedule an appointment at their convenience - directly within the payment portal.

Report

Data-driven insights on campaigns, member/customer behavior, payment activity, and more, in a granular dashboard or reports – that helps provide full visibility into borrower and agent interactions to improve future outcomes.

Improve Collections Efficacy & Efficiency

- Leverage strategic insights into payment activity, engagement, trends, and more to optimize future loan repayment and collection campaign outcomes.

Refine Loan Repayment & Collections Strategy

- Streamline collection efforts with performance analytics on messaging templates, trend identification, and refining tactics for faster recoveries.

Simplify Loan Repayment & Collections Tracking

- Leverage embedded audit trails and proof reports to ensure transparency, accountability, and improved compliance.

The Eltropy Collections 2.0 Effect

240

Credit Unions and Community Banks

$59M

Dollars collected last year

+15M

Reminders sent (text & emails) last year

35+ Integrations

Supported By An Integrated Ecosystem

Eltropy Collections 2.0 seamlessly integrates with your existing and future systems—Collections, Contact Center, Core, CRM, and more—to drive better loan repayment and collection outcomes with minimal disruption.

Quickly and securely connect your workflows with 35+ turnkey integrations for Collections, Core, CRM, LOS, AOS, Marketing, Contact Center, and more.

Artificial Intelligence

Powered By Eltropy Safe AI

Eltropy Collections 2.0 is powered by Safe AI which delivers sharp collection insights, smart automation, personalized engagement, and AI-driven assistance for maximum efficiency and results.

AI Contact Preference

“Show them you know them”

Securely analyze member and customer engagement to identify the best time, channel, and language for communication, keeping collections officers informed and enhancing personalized interactions.

Automated Intelligent Reminders

Sends personalized automatic text reminders, optimizing message timing based on member/customer preferences.

#Enhanced Engagement #Increased click-through rates for higher efficiency

Collection Insights

“Data Rules!!”

Deep insights into collections campaigns.

Comprehensive dashboards with campaign performance analysis that allow collections teams to make data-driven decisions for improved outcomes.

Advanced Collection Intelligence

Rich insights into delinquent members and customers inclusive of underlying reasons.

Enables collectors to approach members and customer with empathy, making each interaction more effective & compassionate.

Assure Quality with AI Scoring

The system automatically scores each call by meticulously analyzing it – to identify reasons for delinquency and ensure adherence to quality standards.

AI Assistant for Collectors

Provides collectors with instant access to policies and procedures [Powered by advanced language models]

#Reduced Average Handle Time (AHT) #Increased First Contact Resolution (FCR) #Improved overall efficiency

Get Started

Get The Winning Workflow

Empower your collections team with empathetic outreach, self-serve flexible payments, automated AI workflows,

and analytics that refine your collections strategy for better collection outcomes.